Removable Pods and Performance Analytics: A More Personalized Approach to Wearable Adoption, Smartwatches and fitness tracker bands currently dominate the activity monitoring market. Still, demand for a more personalized approach could be on the horizon.

Removable Pods and Performance Analytics: A More Personalized Approach to Wearable Adoption, Smartwatches and fitness tracker bands currently dominate the activity monitoring market. Still, demand for a more personalized approach could be on the horizon.

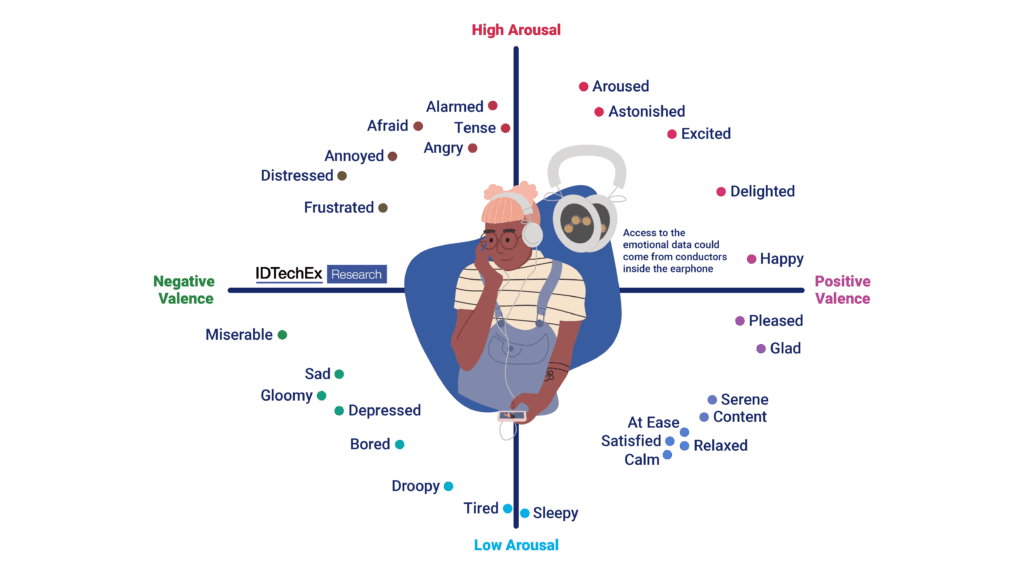

Earphones: Listening to Our Emotions

The adoption of Apple AirPods has grown ten-fold in the last five years, with Bluetooth technology bringing true wireless stereo to the mass market.

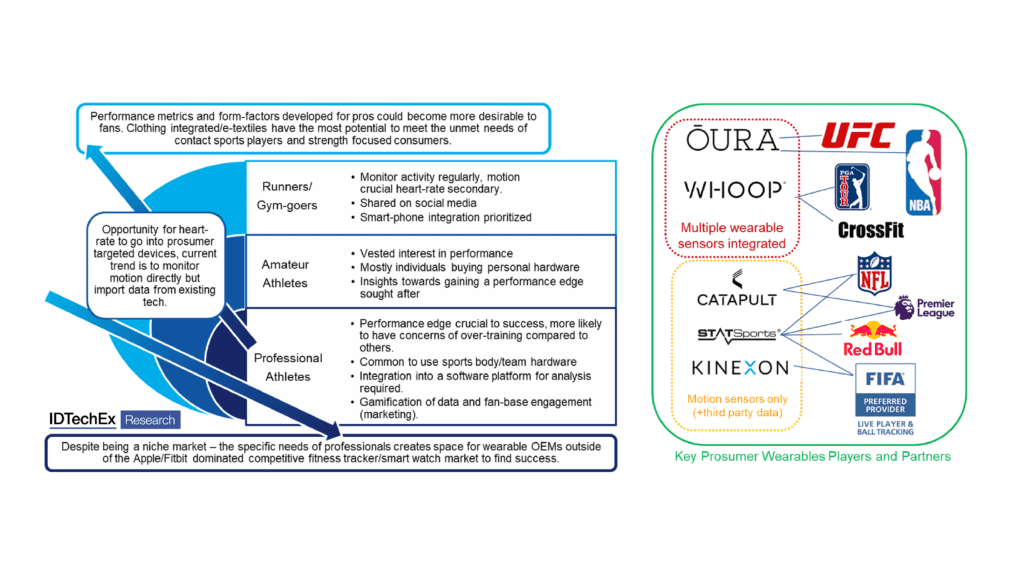

Removable pods can contain the same motion and hear-rate sensors found in smartwatches. Still, they are kept in place via pockets in chest straps, underwear, or trousers (more information on these sensor types is covered in the wearables sensors report). However, the raw motion data available from a watch alone has limits, and the data analytics available from platforms created for athletes also has advantages for the mass market.

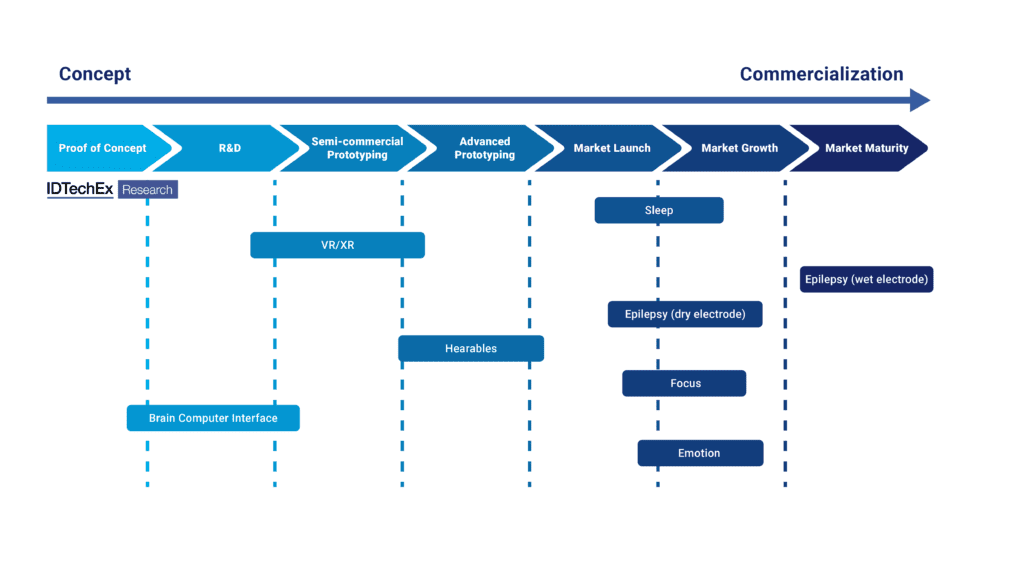

It has long been possible to put optical heart-rate sensors into earphones, and while specific sports devices are available, they have not found their way into the mass market. So, while 2023 could be a little early to see mass adoption of mind-reading earphones, it could well be the time to see a shift in focus from advancements in big brand wrist-wear switch to hearables. Consumers would value the opportunity to curate a more personalized approach to their fitness tracking, combining removable pods, watches, performance analytics, and data sharing to suit their needs.

AR/VR (augmented/virtual reality) headsets already need motion sensors and cameras for eye-tracking. However, the success of this shift will be driven by advancements in display optics, which are still at least a few years away from reaching mass-market-ready levels of miniaturization.

So far, big brands have refrained from adding new sensor technology into their hearables. However, given their unique capability to interpret neural signals, now could be the time for hearables to play a more advanced role in user-data collection via EEG. As such, the possibility for enhanced insights about stress and recovery and the scope to use pods and wristwear is beginning to reach a broader market.

Measurements of signals from the brain can quantify stress, sleep quality, and emotional state, as well as diagnose epilepsy. Consumers left unimpressed by incremental improvements to smartwatch hardware may limit their spending on new consumer electronics to a pair of more impressive earphones.

Removable pods and performance analysis. Source – IDTechEx

Hardware currently limits the use of watches during contact sports as it is too dangerous. We are preparing for the Metaverse.

What lies beyond the smartwatch will largely be dictated by the future of our interaction with one another and the internet.

As the smartwatch market matures, the capabilities of alternative wearables continue to expand. Therefore, it is not hard to imagine the integration of dry electrodes across the forehead, collecting heart rate data and measuring neural signals. The wearable technology industry is driven by the demand for more data – but is faced with hitting maturity during an era of economic contraction. Like their smartwatch companions, the price point for these hearables remains high, and consumers may begin turning to cheaper options without innovation.

Furthermore, motion detectable from the wrist cannot accurately capture specific movements associated with some sports — for example, weightlifting or body strength exercises. In the future, packages targeting amateur athletes and the broader wellness market will likely emerge. This trend is likely to continue in 2023, especially given much of the value in this business model lies in the software. Today, it is standard to use a laptop, smartphone, and possibly a smartwatch for activity tracking and hands-free communication if desired.

The design of phones has stagnated in recent years, and combined with ‘zoom fatigue’ following the pandemic, there are signs consumers are hungry for something more immersive. The proximity of the ear to the brain could give more advanced earphones a commercial advantage in the coming years. One solution proposed for the professional athlete market is using removable pods. This could make it more affordable for the consumer market, who would value receiving upgraded hardware as a standard.

However, earphones have a fundamental advantage that wrist-wear does not – they are near the brain. Moreover, earphones cannot offer real-time data visualization. Yet in recent years, some companies, such as Naox Technologies and Kokoon, have demonstrated that EEG-integrated hearables are feasible. In the coming years, alternative form factors could begin tempting consumers away. Metal electrodes used to measure electric signals from the heart (ECG) can also measure neural activity (EEG).

Wearable biometrics will likely follow if society switches to headgear for messaging, web browsing, and gaming. While they may look unsettling to some now, this time next year, society will likely be far more comfortable with them. It is also because it provides a repeat data set available from the watch.

Not only could these devices provide more value – but they also have the potential to access new biometrics. In tandem, the demand for emotional state data is also growing. The development of augmented reality headsets and smart glasses could make the smartphone redundant, taking smartwatches with it. This kind of revolution will likely paint a picture of the world beyond the smartwatch.

As such, interim products (such as camera-integrated Ray Bans) will likely continue to be released to make them more fashionable. Much of the value obtained from our wearables is from the software analyzing our movements. Similarly, professional golfers and cyclists are adopting Whoop bands which can be worn on the wrist or adapted for insertion into clothing.

This is covered in IDTechEx’s dedicated report on wearables sensors. It is already possible to buy EEG-integrated headbands, but these are far less fashionable and mostly sold as novelty toys.

For some companies, elite athletes have served as a marketing tool for their wearables.

But this ecosystem has been the status quo for many years now and could be set for disruption. This allows companies, such as Whoop, to offer a subscription to their platform, which includes the hardware. The challenge for an in-ear solution has been the miniaturization of electronics and noise cancellation.

This is likely because the priority has been on enhancing audio quality. In the meantime, headgear and smart glasses need to become more socially accepted. It is now common to see premiere league footballers and NFL players wearing chest straps from Statsport or Kinexon. Similarly, gaming headsets are already seen in many TV advertisements. Indeed, implantable electrodes are already being used to communicate with exoskeletons to enable paraplegics to walk.

This article summarizes what life could look like beyond the smartwatch boom, with three trends to watch.

Conclusions.

The marketing challenge facing manufacturers looking to appeal to a broader demographic of consumers, elite athletes, and the medical market is non-trivial but is equally outside the expertise of today’s consumer electronics kingmakers. Granular forecasts segmented by technology and application assist with planning future projects, while multiple company profiles based on primary interviews provide detailed insight into the major players.

IDTechEx offers an extensive portfolio of technology market research reports covering many aspects of the wearable technology space. This feature will likely see consumer adoption of new wearables depending on connectivity to existing smartwatches.

The ultimate hurdle facing earphones, removable pods, and headsets is balancing data access with visualization and social acceptance. Monitoring activity in real-time is a significant advantage of wearables; seeing it live on a watch is a huge selling point. The real opportunity is within the next generation of wearables, and smartwatches will interface to satisfy the demand for new functionality. All of these reports cover the current state and expected future developments in terms of technical capabilities and commercial adoption.

Further details and downloadable sample pages for each report can be found on the IDTechEx website, and to find out more about IDTechEx wearable technology research, please visit www.IDTechEx.com/Research/WT. Also included in the reports are multiple application examples, SWOT analysis, and technological/commercial readiness assessments. These include wearables sensors, electronic skin patches, AR/VR, e-textiles, and hearables.

This market has more room for new players, materials, and innovation. IDTechEx also has related content dedicated to remote patient monitoring, diabetes management, and printed sensors. As for social acceptance, integration into hardware owned by the right brand will be crucial.

Written by: Matthew Thomas