In a dramatic revelation, Juniper Research’s latest study highlights a staggering increase in fraudulent banking and money transfer transactions, projecting a 153% rise to an alarming $48 billion globally by 2029. This explosive growth from $19 billion in 2024 underscores the escalating threat posed by sophisticated fraudsters leveraging artificial intelligence.

In a dramatic revelation, Juniper Research’s latest study highlights a staggering increase in fraudulent banking and money transfer transactions, projecting a 153% rise to an alarming $48 billion globally by 2029. This explosive growth from $19 billion in 2024 underscores the escalating threat posed by sophisticated fraudsters leveraging artificial intelligence.

The comprehensive report, titled Global Fraud Detection & Prevention in Banking Market 2024-2029, illuminates the urgent need for banks to enhance their fraud detection capabilities. As fraudsters become more adept with AI, banks are also ramping up their use of advanced AI technologies to combat this menace effectively.

Leading the Market in Fraud Detection and Prevention

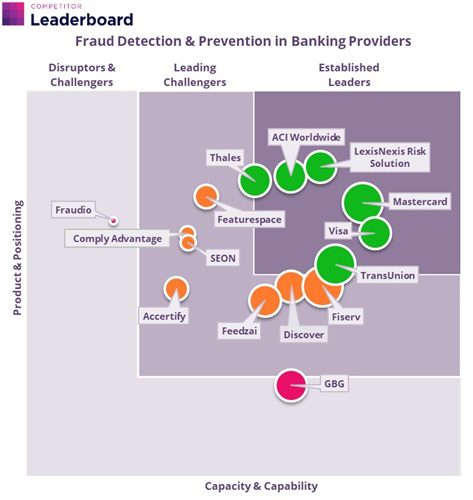

Juniper Research’s newly released Competitor Leaderboard identifies the top 15 vendors excelling in fraud detection and prevention in the banking sector. The evaluation criteria include the robustness of their solutions, global presence, and future growth prospects. Leading the pack for 2024 are:

- LexisNexis Risk Solutions

- Mastercard

- Visa

- ACI Worldwide

- Thales

These frontrunners are recognized for their innovative approaches and comprehensive offerings. However, the report emphasizes the critical need for vendors to develop rapid real-time solutions to tackle emerging threats such as Authorised Push Payments (APP) fraud.

Innovation and Speed: The Key to Staying Ahead

The report’s author, Cara Malone, stresses the importance of instant payments and the challenges they pose. “Instant payments increase the speed of transactions, reducing the window for banks to intervene and diminishing the effectiveness of traditional fraud detection tools,” Malone explains. Fraud detection and prevention vendors must leverage AI to enable real-time risk scoring and prevention.”

A Comprehensive Research Suite

The Global Fraud Detection & Prevention in Banking Market 2024-2029 research suite stands as the most detailed evaluation of the market to date. It provides critical analysis and five-year forecasts across 60+ countries, encompassing over 24,000 market statistics. The suite’s ‘Competitor Leaderboard’ thoroughly examines the leading players and future market opportunities.

For more information on the report or to download a free sample, visit Juniper Research.

Key Insights and Recommendations

The report concludes with key recommendations for market leaders. To maintain their edge, vendors must innovate and adopt real-time AI-driven solutions. The call for rapid adaptation is clear—those who can evolve swiftly will dominate the market, ensuring robust protection against the relentless threat of banking fraud.

Conclusion

The battle against banking fraud is intensifying. The industry is poised for significant advancements, with LexisNexis Risk Solutions and Mastercard at the forefront. However, the road ahead demands continuous innovation and agility to stay ahead of increasingly sophisticated fraudsters.

Written by: Anne Keam