Summary

- Travel players reached out to capital markets for support over the recent months to stand back on their feet.

- Helloworld announced ~$50 million equity raising to bolster its balance sheet flexibility and manage liquidity crunch.

- Webjet will obtain another cash top-up with its offering of €100 million convertible notes after April 2020 equity raising.

- FLT secured access to up to GBP65 million of debt facility to offset COVID-19 repercussions on its UK businesses.

- Qantas declared equity raising activity to raise up to $1.9 billion, as a part of its three-year recovery plan.

While the COVID-19 pandemic has sent world’s financial markets into a tailspin, capital raisings to sustain businesses and aid innovation are gaining significant traction, with recent instances bespeaking travel companies’ approaches to address coronavirus-driven challenges in the best of their abilities.

After a steep plunge in travel demand amid coronavirus-induced restrictions, the hard-hit travel companies have been rushing to shore up their finances to ride through liquidity storm. In order to manage working capital requirements and navigate through medium to long term fund flows, several ASX-listed travel players have reached out to capital markets for support over the recent months to stand back on their feet.

Helloworld Unfurls $50 Million Capital Raising

Travel distribution player, Helloworld Travel Limited (ASX:HLO) has recently announced a fully underwritten ~$50 million equity raising to bolster its balance sheet flexibility and provide liquidity to manage the extended period of disruption to the international travel industry.

The ~$50.0 million equity raising comprises ~$27.1 million fully underwritten Placement and ~$22.9 million Entitlement Offer, which further consists of ~$17.5 million Institutional Entitlement Offer and ~$5.4 million Retail Entitlement Offer. The Company has lately completed both Placement and Institutional Entitlement Offer, while the Retail Entitlement Offer is likely to open on 23rd July 2020.

The Company expects its liquidity position (with ~$187.1 million cash and facilities) to get enhanced subsequent to the completion of Equity Raising, providing it sufficient liquidity to serve for capital and operating expenditure through to the end of 2022, assuming ongoing disruption to the global travel markets.

Another Cash Top-Up in Webjet’s Account

Travel agency player, Webjet Limited (ASX:WEB) will obtain another cash top-up after April 2020 Equity Raising, with its offering of €100 million ($163 million) convertible notes, as declared on 1st July 2020. To sustain a prudent capital structure, the Company announced convertible notes offering due 2027, which will be used for the following purposes:

- repay $50 million of its existing term debt while extending remaining term debt maturity into late 2022,

- ongoing capital management, and

- potential acquisitions.

As the Company observed nominal TTV and total revenue in April and May 2020 due to COVID-19-induced travel restrictions, it is still required to meet its operating expenditure and other costs. What’s worth noting is that the Company’s cost management measures caused a reduction of ~ $13 million from its pre COVID-19 expenditure, with costs averaging around $15 million per month from April 2020 to the end of June 2020.

Qantas Announced Capital Raising for Stronger Future

In June this year, Australian airline Qantas Airways Limited (ASX:QAN) declared equity raising activity to raise up to $1.9 billion, comprising ~$1,360 million fully underwritten institutional Placement and up to $500 million non-underwritten Share Purchase Plan.

Qantas successfully completed the Placement activity in late June 2020 with robust investor support from both existing institutional shareholders and new investors. The Company plans to utilise the proceeds raised from Equity Raising to accelerate its recovery, capitalise on opportunities aligned with its strategy and strengthen its balance sheet.

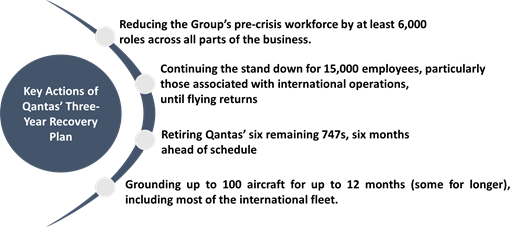

To fast-track its revival from coronavirus crisis, the Company has also announced a three-year recovery plan, which is likely to deliver benefits of $15 billion over the three years.

Flight Centre Travel Group Plans to Take Up Additional Funding

Australian travel agency firm, The Flight Centre Travel Group (ASX:FLT) has recently secured access to up to GBP65 million of debt facility that will be drawn as and when needed to offset COVID-19 repercussions on its UK businesses.

The funding has been made available through Bank of England’s Covid Corporate Financing Facility, aimed at supporting short-term liquidity among firms working to overcome coronavirus disruption. Previously, the Company also declared a ~$700 million fully underwritten equity capital raising in April 2020, which comprised a ~$282 million Placement and an ~$419 million Entitlement Offer.

Equity raising was announced as a part of FLT’s strategic initiatives targeted at ensuring its smooth sail through an extended period of uncertainty and disruption. With over 30 years of a long history of delivering high quality travel services to customers, FLT seems well positioned to benefit from a gradual recovery in travel and tourism sector.

With fears of second infection wave mounting in Australia, the existing scenario calls for several other companies in travel and additional sectors to seek capital in the days ahead to breeze through crisis. However, a continuation of government support schemes beyond September and potential resumption of international travel can lend a helping hand to the battered travel sector.

Source: Kalkine Media