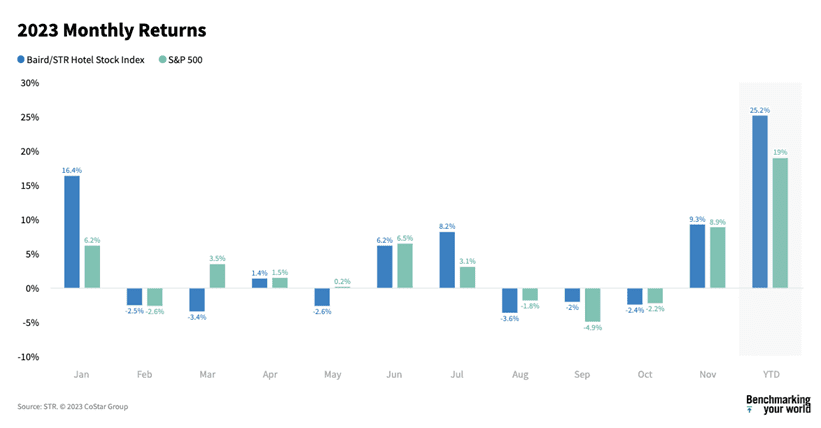

The Baird/STR Hotel Stock Index increased 9.3% in November to a level of 6,119.

The Baird/STR Hotel Stock Index increased 9.3% in November to a level of 6,119.

“Hotel stocks rose sharply in November and snapped a three-month losing streak; performance generally tracked the benchmarks,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Lower interest rates primarily drove the gains during the month, particularly for real estate stocks, and overall investor sentiment improved. Year to date, the hotel REIT sub-index turned positive and is now +7.6%, while the hotel brand sub-index at +30.6% continues to be a relative outperformer.”

“As expected, U.S. hotel demand dipped slightly in November due to lessened group travel during Thanksgiving week,” said Amanda Hite, STR president. “The industry will see some benefit from an extended break between Thanksgiving and Christmas, allowing business travelers and groups to squeeze in one last visit before year’s end. We recently upgraded our 2023 ADR and RevPAR forecast, which reflects the continued buoyancy of travelers, and expect to see continued RevPAR growth into the new year as room rates remain strong.”

In November, the Baird/STR Hotel Stock Index surpassed the S&P 500 (+8.9%) but fell behind the MSCI US REIT Index (+10.2%).

The Hotel Brand sub-index increased 8.6% from October to 11,627, while the Hotel REIT sub-index jumped 12.1% to 1,117.