A recent analysis by CoStar and STR, set to be unveiled at the upcoming NoVacancy Hotel + Accommodation Industry Expo, reveals a significant shift in the Australian hotel sector, with corporate demand rising as leisure travel reaches its zenith. This normalization is a vital indicator of the hotel industry’s resilience and adaptability in a post-pandemic world.

A recent analysis by CoStar and STR, set to be unveiled at the upcoming NoVacancy Hotel + Accommodation Industry Expo, reveals a significant shift in the Australian hotel sector, with corporate demand rising as leisure travel reaches its zenith. This normalization is a vital indicator of the hotel industry’s resilience and adaptability in a post-pandemic world.

CoStar, a premier provider of online real estate marketplaces, information, and analytics in the property markets, collaborates with STR, its data benchmarking, analytics, and marketplace insights provider for the global hospitality industry, to bring forth this insightful analysis.

During the first seven months of this year, Australia recorded a hotel occupancy rate of 68.2%, a marked improvement of 9.8% from the previous year, albeit 6.0% lower than 2019. Interestingly, the average daily rate (ADR) stood at AUD 234.46, reflecting a 7.4% increase from last year and a remarkable 22.4% surge from 2019. This upswing in ADR has propelled the revenue per available room (RevPAR) to index at 120, indicating a 20% rise compared to 2019 since April 2022.

Matthew Burke, STR’s regional director for the Pacific, Central South Asia, and Japan noted, “Australia is mirroring the trend observed in many other countries, transitioning into a normalisation phase. This transition is fueled by domestic leisure travel reaching its peak in 2022. Despite room prices being considerably higher than in 2019, the rate of growth year over year has been minimal. This doesn’t signify a loss, but rather a shift, as we’ve witnessed gains in capital cities and on days predominantly associated with corporate demand.”

Burke will delve deeper into historical performance, profitability, and forward bookings during his NoVacancy presentation titled “Industry Outlooks: Prepare for the challenges and opportunities of the future,” scheduled for 11:30 a.m. on Friday, 1 September.

Cities such as Brisbane, Perth, Sydney, and Melbourne showcased varying occupancy trends. Brisbane recorded the highest occupancy index peaks, touching 114 in early July. Perth remained above 2019 levels for a significant part of the year, peaking at 125 in late April. Conversely, Sydney trended below 2019 levels for most of the year but surpassed that threshold for two consecutive weeks in late July. Despite grappling with a higher supply volume, Melbourne lagged behind 2019 comparables.

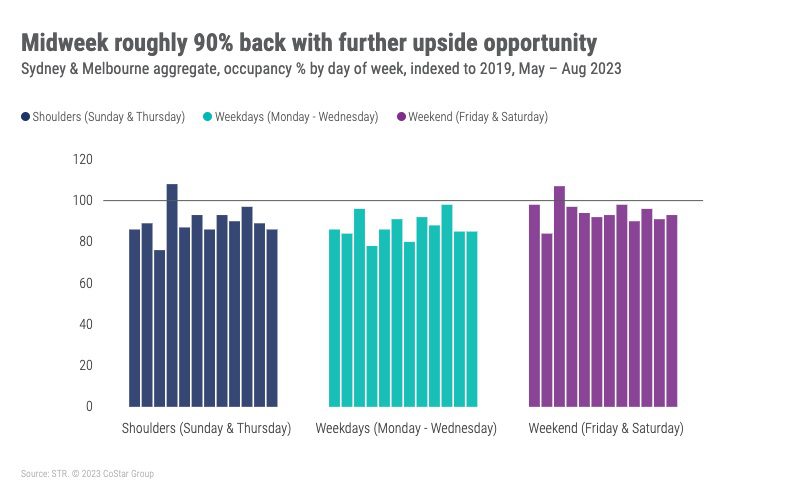

The analysis also highlights an interesting pattern in weekday (Monday-Wednesday) occupancy, which experienced the most substantial growth compared to the previous year, earlier in 2023. This growth remained consistent in recent months, while shoulder days (Sunday and Thursday) experienced fluctuations, and weekends (Friday-Saturday) saw a decline. Compared to 2019, weekends are the furthest recovered, whereas weekdays reached 98% of pre-pandemic comparables in late July.

“High weekend occupancy continues, driven by major events, which are significant attractors for future bookings and high ADR,” Burke explained. “The midweek period presents a considerable opportunity as international meetings, large-scale events, corporate, and day-agnostic international leisure are gradually resuming. Anecdotally, there is evidence that the finance and professional service sectors’ corporate travelers have been slower to recover than other industries. Considering all these factors, we remain cautiously optimistic, anticipating further improvement in international and corporate demand.”

For more information about CoStar and its products and services, please visit www.costargroup.com.

Written by: Christine Nguyen