I n a remarkable testament to resilience and strategic foresight, the Asia-Pacific and Middle East regions are poised to reassert themselves as the dynamos of global economic growth in 2024. This resurgence is underscored by the latest Airports Council International Asia-Pacific & Middle East (ACI APAC & MID) findings, encapsulated in their Airport Industry Outlook. The report, a collaborative effort with Mott MacDonald, delineates a burgeoning recovery arc in passenger traffic and airport financials, albeit shadowed by the overarching macroeconomic uncertainties.

n a remarkable testament to resilience and strategic foresight, the Asia-Pacific and Middle East regions are poised to reassert themselves as the dynamos of global economic growth in 2024. This resurgence is underscored by the latest Airports Council International Asia-Pacific & Middle East (ACI APAC & MID) findings, encapsulated in their Airport Industry Outlook. The report, a collaborative effort with Mott MacDonald, delineates a burgeoning recovery arc in passenger traffic and airport financials, albeit shadowed by the overarching macroeconomic uncertainties.

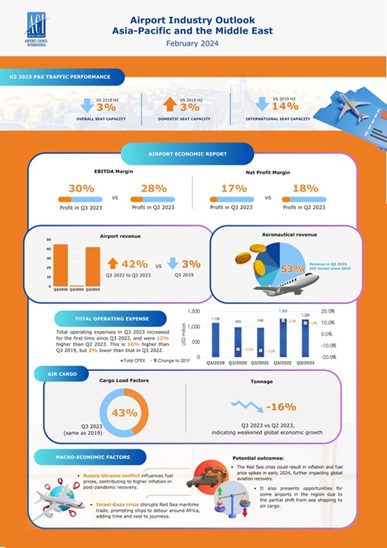

Delving into the fabric of the report reveals that the latter half of 2023 has nearly bridged the chasm to pre-pandemic aviation benchmarks, with overall seat capacity trailing a mere 3% behind the zeniths 2019. A granular view presents a mixed tapestry: domestic capacity inches ahead by 3%, while international capacity still grapples with a 14% shortfall. The narrative, however, takes a pivot with the advent of 2023, as China’s border reopening injects a dose of vitality across Asia-Pacific skies, propelling traffic volumes to the cusp of 90% of the erstwhile norms. The Middle East, not to be outpaced, has a growth narrative of its own, charting a 4% ascendancy over the 2019 tallies.

Asia-Pacific and the Middle East region are expected to return as engines of global economic growth in 2024.

The horizon for 2024 gleams with the promise of a full-fledged revival for the Asia-Pacific sector, concurrently with the Middle East navigating towards an epochal year anticipated to surpass the 450 million passenger mark. This projection is a number and a harbinger of the region’s rekindled role as the crucible of global economic momentum. The narrative, however, is not devoid of its share of trials, with geopolitical undercurrents and the persistent Red Sea crisis casting long shadows. These challenges, paradoxically, may also unfurl new avenues, especially in the air cargo domain, potentially reshaping logistics dynamics in the wake of maritime disruptions.

The pulse of the airport’s economic vitality is palpable in the cargo load factors (CLFs), with Asia-Pacific and the Middle East demonstrating resilience and adaptability amid fluctuating global trends. The meticulous analysis by Stefano Baronci, Director General of ACI Asia-Pacific & Middle East, underscores the region’s pivotal role in steering the global growth trajectory, poised to commandeer nearly 40% of the worldwide passenger and cargo traffic market share in 2024. Baronci’s vision transcends the ephemeral, aiming to eclipse the “pre-COVID recovery” lexicon with a narrative of unabated growth and prosperity, anchored by a 3% growth forecast for Asia-Pacific and a robust 14% for the Middle East, vis-à-vis the 2019 benchmarks.

As detailed in the report, the economic underpinnings reflect a sector in the throes of a steadfast recovery. Airports across these regions have managed to sustain operational profitability and witnessed a tangible uplift in EBITDA margins amidst the whirlwinds of increasing operational expenses. The symbiotic relationship between traffic recuperation and financial health underscores a sector on the mend, albeit navigating the headwinds of escalating labour and energy costs.

This comprehensive analysis, drawn from the latest Airport Industry Outlook, maps the recovery trajectory and illuminates the path forward for the Asia-Pacific and Middle East regions. It is a testament to the indomitable spirit of the aviation sector, underpinned by strategic resilience and a forward-looking ethos. As these regions gear up to reclaim their mantle as the engines of global growth, the narrative transcends mere recovery, heralding a new era of economic dynamism and connectivity.

Written by: Soo James