In an era of recovery and resilience, the United Kingdom stands on the precipice of a significant resurgence in its tourism sector. The latest forecast by VisitBritain paints a picture of hope and growth, projecting an impressive uptick in both the volume and value of inbound tourism for 2024. This anticipatory narrative, rooted in robust data and astute market analysis, offers a compelling glimpse into a future where the UK reclaims its stature as a premier global destination.

In an era of recovery and resilience, the United Kingdom stands on the precipice of a significant resurgence in its tourism sector. The latest forecast by VisitBritain paints a picture of hope and growth, projecting an impressive uptick in both the volume and value of inbound tourism for 2024. This anticipatory narrative, rooted in robust data and astute market analysis, offers a compelling glimpse into a future where the UK reclaims its stature as a premier global destination.

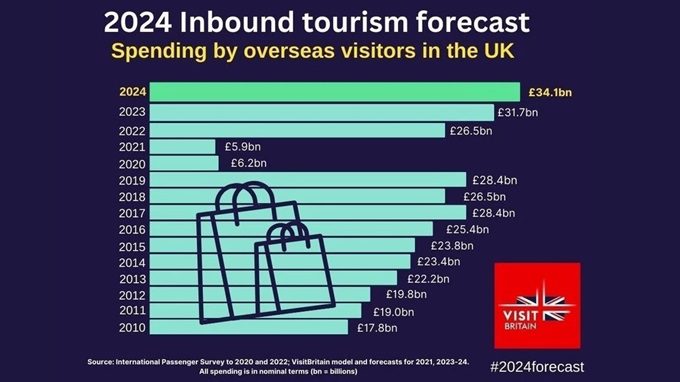

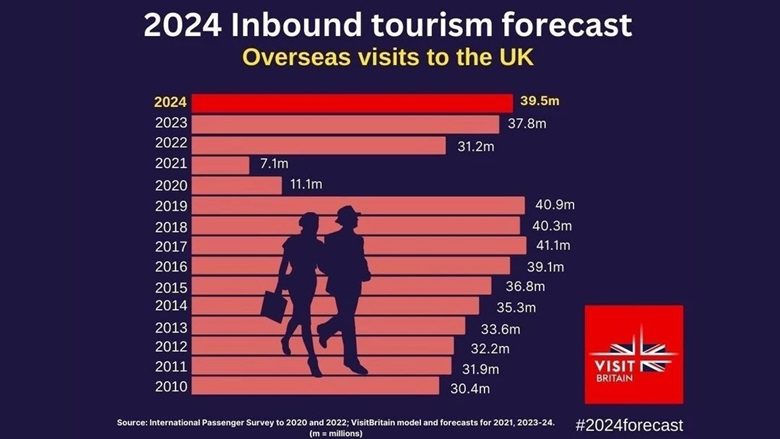

The 2023 performance set a formidable foundation, with VisitBritain estimating 37.8 million inbound visits and a staggering £31.7 billion in expenditures. Remarkably, these figures represent 92% and 112% of the 2019 levels, respectively, when adjusted for inflation. Such an achievement is not just a recovery but a monumental leap, setting a record for spending nominally.

The horizon for 2024 shines even brighter. VisitBritain forecasts an escalation to 39.5 million visits and a remarkable £34.1 billion spend. These projections signal a return to near pre-pandemic vibrancy, achieving 97% and 120% of the 2019 levels, respectively. However, when the lens of inflation is applied, the spending is adjusted to 96% of the 2019 figure. Compared to 2023, this upward trajectory represents a growth of 5% in visits and 7% in nominal spending, a clear indicator of the sector’s robust health.

Delving deeper into the forecast reveals intriguing patterns and trends. Despite a mid-year plateau in recovery, with visits in July-September dipping to 89% of 2019 levels, the overall trajectory remains positive. The intricate weave of various data, including flight bookings, suggests a sustained but slightly lagging recovery compared to 2019.

The composition of the inbound market is as diverse as it is dynamic. European inbound tourism is expected to rebound to 95% of visits and 116% of spend. Long haul markets outpace this recovery, projected to achieve 101% and 123% in visits and spending, respectively. The Americas lead the charge in rapid return, while East Asia’s pace is more measured.

Visitor spending patterns offer a kaleidoscope of insights. While inbound spending in nominal terms outpaces the number of visits, the real picture, adjusted for inflation, aligns closely with the volume of visits. An in-depth analysis of the first half of 2023 reveals a nuanced narrative: a 6% dip in visits but a 7% increase in nights stayed, indicating a more extended average stay but a decrease in spend per night when inflation is factored in.

The global economic context provides a crucial backdrop to these forecasts. A recent slowdown in the worldwide economy, especially in the Eurozone, tempers expectations for an immediate return to 2019 levels. However, the underlying assumption is a gradual easing of the global cost of living pressures, contributing to a steady, upward trajectory in international travel.

In conclusion, the forecast for UK tourism in 2024 is a testament to the sector’s resilience and adaptability. With assumptions of a stable global environment and no fresh COVID-related challenges, the UK is poised to witness a remarkable resurgence in its tourism sector. This forecast, slated for revision in mid-2024, offers optimism for an industry that is an integral part of the UK’s economic and cultural fabric.

Written by: Jill Walsh