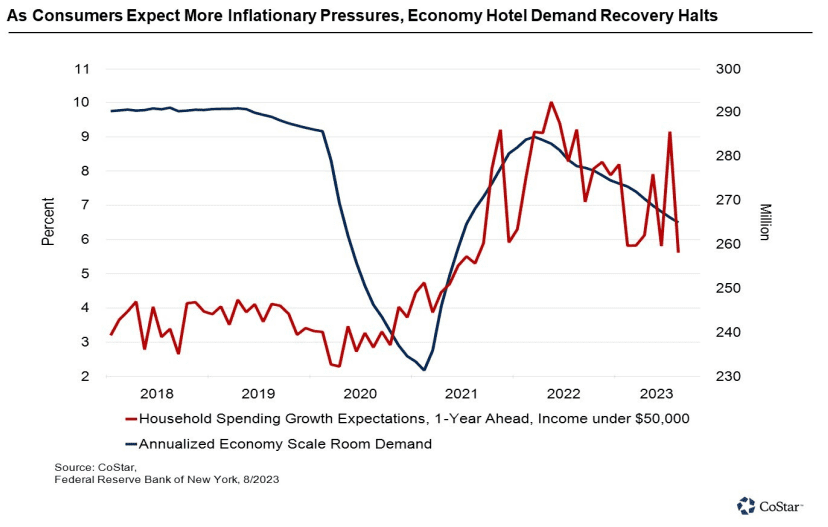

Monthly demand for rooms at Economy hotels has been declining since April 2022. This stands in contrast to other hotel segments, where room demand started to recover in the late spring of 2021 and has continued its rise. One of the potential reasons for this decline is that consumers who make less money are worrying that their future expenses are rising quickly. This expectation might motivate them to reduce travel plans, find alternative accommodations with friends and family or dissuade them from traveling at all.

The Federal Reserve Bank of New York conducts a monthly survey that collects consumer expectations about their household spending growth a year ahead. Consumers likely take into consideration their most recent purchases and what they hear about in the media, and then guess how much their spending will change. The bank segments the survey by three different income levels.

In the years before the pandemic, the spending growth expectations of households with incomes of less than $50,000 per year was muted and in a somewhat predictable range of between 2% and 4%.

But in the most recent past, the survey shows a sharp uptick in the expectations of price increases for these lower income earners. The outcome of this is likely that discretionary spending on items such as travel gets curtailed to fund higher expenses that loom on the The annualized economy segment hotel demand peaked after its 2020 trough at around 285 million rooms sold, and has since declined to 265 million room nights this summer. As inflationary pressures ease for consumers, it is possible that the inflation expectations will also decelerate. This in turn could lead to an increase in economy hotel spending in the coming quarters.