![]() In a surprising twist of economic events, Australia’s spending momentum has surged forward, even as citizens grapple with escalating living expenses. The Visa Australia Spending Momentum Index (SMI) recorded a promising 5.7-point jump, settling at 100.5 in August. This progression shows that many Australians are more liberal with their wallets than a year ago.

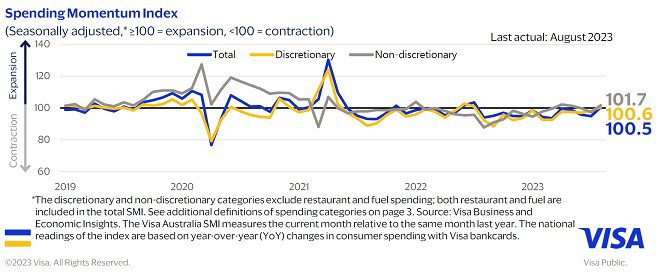

In a surprising twist of economic events, Australia’s spending momentum has surged forward, even as citizens grapple with escalating living expenses. The Visa Australia Spending Momentum Index (SMI) recorded a promising 5.7-point jump, settling at 100.5 in August. This progression shows that many Australians are more liberal with their wallets than a year ago.

Factors contributing to this surge include soaring fuel prices, a static cash rate, and a notably robust job market. The remnants of last August’s spending slump, partly attributed to the calamitous floods in New South Wales in July 2022, also played a role in this month’s uplifting performance. This turnaround in spending habits illustrates the nation’s economic resilience in adversity.

Fuel prices have emerged as a pivotal player in this economic narrative. August witnessed consumers digging deeper into their pockets, shelling out 15% more at fuel stations year-on-year. Notably, this price hike comes on the heels of three successive months of price drops, which stemmed from strategic production trims by the influential Organisation of the Petroleum Exporting Countries (OPEC).

Yet, the fuel SMI paints a not-so-rosy picture, remaining in a contraction phase. In contrast, both discretionary and non-discretionary spending metrics reflected positive vibes. Recording upticks of 2.3 points and 4.3 points, respectively, these sectors experienced an unexpected boom, partly due to inflation-driven price inflations. The gastronomic landscape, however, had its own tale to tell. A slight dip in the restaurant SMI mirrored a year-on-year decrease in patrons dining out.

A notable highlight from these economic readings is that the overall SMI has surpassed the 100 mark for the first time this calendar year. But, as experts caution, this isn’t a conclusive inflection point. The uptrend leans heavily on credit transactions, indicating Australians prefer to tap into available credit lines to navigate these uncertain times. Compounded by a dip in the household savings rate in the second quarter of 2023, the data suggests that Australians might be treading on thin ice, balancing higher mortgage outlays and the omnipresent inflation spectre. However, a silver lining remains. Australians’ credit health is far from frail, with repayment data and credit limits showcasing their fiscal prudence.

Written by: Anne Keam