![]() Alton Aviation Consultancy’s New Report Forecasts a Decade of Steady Expansion for the Global Commercial Aircraft Fleet Amid Intensifying Sustainability and Supply Chain Concerns.

Alton Aviation Consultancy’s New Report Forecasts a Decade of Steady Expansion for the Global Commercial Aircraft Fleet Amid Intensifying Sustainability and Supply Chain Concerns.

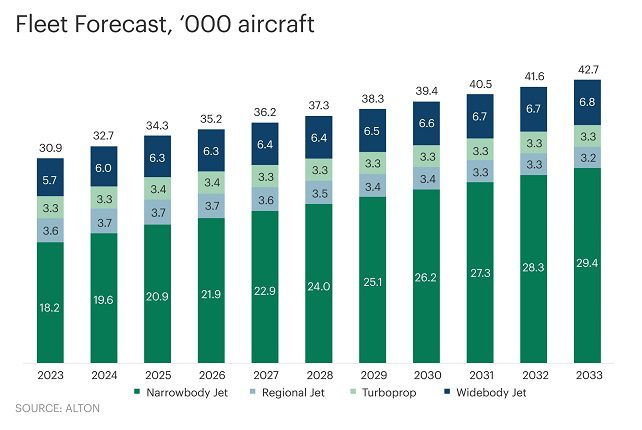

In a period of significant turbulence and uncertainty in the aviation industry, Alton Aviation Consultancy’s recently published forecast paints a picture of resilience and measured growth. Despite substantial geopolitical and supply chain issues currently challenging Original Equipment Manufacturers (OEMs), the global commercial aircraft fleet is expected to grow by 3.3% annually over the next decade. From the present count of 29,000, we can anticipate an impressive rise to approximately 42,000 by 2033.

The industry’s recovery process is comprehensively mapped out in Alton’s 2023-2033 Commercial Aircraft and Engine Fleet Forecast. The analysis offers a decade-long forecast of air traffic and the active fleet while elucidating OEMs’ roles in this changing landscape. While new significant programs are not expected to be launched immediately, the report points to the importance of continued technology development. The ongoing pressure from the market for the sector to advance its sustainability goals means OEMs are poised to launch new aircraft programs in the mid-term.

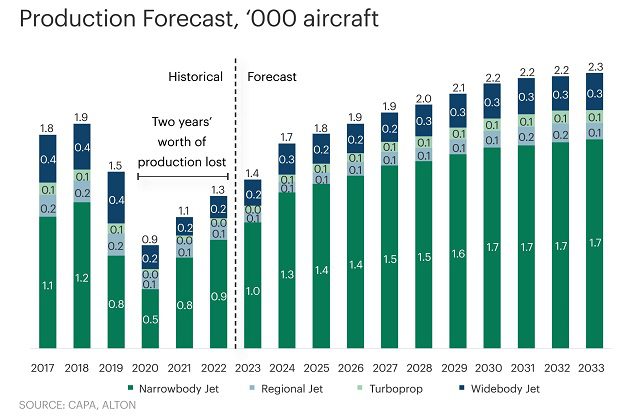

According to Adam Guthorn, one of the report’s co-authors and managing director in Alton’s New York office, aviation recovery is definitely in progress, albeit fragmented. “While we forecast air traffic to return to pre-pandemic levels in 2024, this recovery will vary by region, with Asia Pacific not returning to 2019 levels until early 2025,” Guthorn said. He further elaborated that supply chain complications and labour shortages have stifled the ability of OEMs to ramp up production at a pace that matches short-term demand for new aircraft.

According to Joshua Ng, the report’s other co-author and director of Alton’s Singapore office, sustainability has emerged as a paramount concern post-pandemic, and it will significantly influence the future direction of the aviation industry. “With significant aircraft order backlogs for in-production aircraft types, the immediate focus for airframe OEMs like Airbus and Boeing will be operational improvements aimed at increasing production rates to meet current demand,” Ng stated. He also noted that the industry’s sustainability goals are unlikely to be met through reductions in carbon emissions from new technology engines alone. Thus, the focus has shifted towards sustainable aviation fuel (SAF) that can be utilized by existing aircraft in the near term.

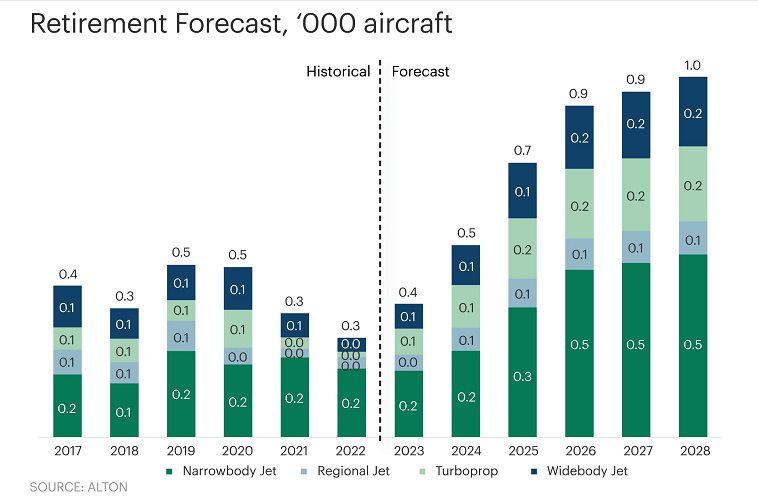

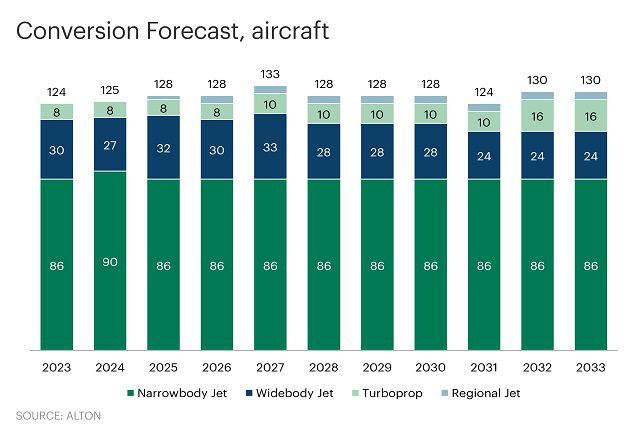

Alton’s report also highlights the impacts of supply chain challenges on aircraft retirements and leasing trends. With the former falling below historical averages, demand for leasing, particularly narrowbody jets, has skyrocketed. The report also identifies the continuing momentum for cargo conversion, driven by the need to replace aging fleets.

Given the inherent uncertainties of our time, Alton’s report serves as a crucial navigational tool, providing detailed insight into the industry’s trajectory for the next decade. The document’s analytical rigour and foresight underscore its value to stakeholders seeking to make informed decisions in an ever-evolving landscape.

Written by: Jason Smith