![]() In a surprising turn of events, Australian consumers have shown renewed confidence in their discretionary spending habits, driven by unchanged interest rates, according to the latest findings from Visa’s Australia Spending Momentum Index (SMI). The index experienced a significant surge of 6.1 points, reaching a robust 99.7 in April. Concurrently, non-discretionary spending increased by 2.6 points, marking a steady and sustained acceleration of 102.2. These findings reflect a notable shift towards essential expenditures, with non-discretionary spending momentum expanding and discretionary spending adapting to policy changes.

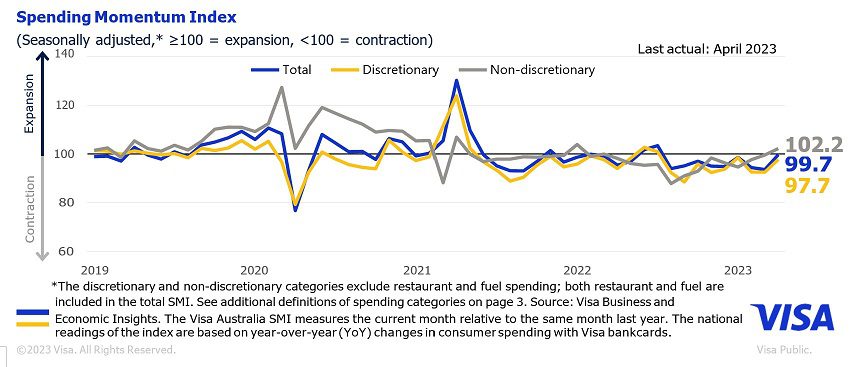

In a surprising turn of events, Australian consumers have shown renewed confidence in their discretionary spending habits, driven by unchanged interest rates, according to the latest findings from Visa’s Australia Spending Momentum Index (SMI). The index experienced a significant surge of 6.1 points, reaching a robust 99.7 in April. Concurrently, non-discretionary spending increased by 2.6 points, marking a steady and sustained acceleration of 102.2. These findings reflect a notable shift towards essential expenditures, with non-discretionary spending momentum expanding and discretionary spending adapting to policy changes.

The Reserve Bank of Australia’s decision to pause interest rate hikes in April created an opportune moment to analyze the impact of interest rate announcements over the past year on the three spending momentum measures. It is important to note that this analysis encompasses monetary policy moves until April, providing a comprehensive overview of the evolving consumer behaviour landscape.

As anticipated, non-discretionary spending momentum displayed less sensitivity to interest rate adjustments. On average, this category exhibited weakened momentum after 50-basis-point (bp) rate hikes, remaining relatively stable in response to unchanged or 25bp rate increase announcements. The sustained resilience of non-discretionary spending indicates its fundamental importance in meeting everyday needs, regardless of interest rate fluctuations.

In stark contrast, discretionary spending momentum was highly responsive to policy change announcements. The data revealed that months with no policy change experienced an encouraging improvement of 5 points in discretionary spending. Conversely, after 25bp rate increase announcements, discretionary spending showed little change, while news of 50bp rate hikes led to a decline of approximately 2.5 points. These findings highlight the impact of policy adjustments on consumer sentiment and discretionary spending patterns, underscoring the need for businesses to monitor interest rate developments closely.

Analyzing the overall SMI, it becomes evident that recent policy tightening has prompted consumers to moderate their discretionary spending and reallocate funds towards non-discretionary expenditures. This shift in spending patterns signifies a conscious effort by Australian consumers to adapt to changing economic conditions and prioritize essential needs, thereby ensuring financial stability in uncertain times.

Visa’s Australia SMI report sheds light on consumer spending trends and is a valuable resource for businesses seeking to understand the dynamic relationship between monetary policy and consumer behaviour. By leveraging these insights, companies can make informed decisions regarding product offerings, marketing strategies, and inventory management.

To delve deeper into the data and gain a comprehensive understanding of Australia’s spending landscape, access the full Visa Australia SMI report [LINK]. The report provides an in-depth analysis of spending trends across various sectors and demographics, allowing businesses to effectively tailor their approach to target specific consumer segments.

In conclusion, Australian consumers have responded positively to unchanged interest rates, leading to a surge in discretionary spending momentum. However, non-discretionary spending remains the bedrock of consumer behaviour, exhibiting steady growth despite interest rate adjustments. As businesses navigate the ever-evolving economic landscape, understanding the interplay between policy changes and consumer spending patterns will be paramount to their success.