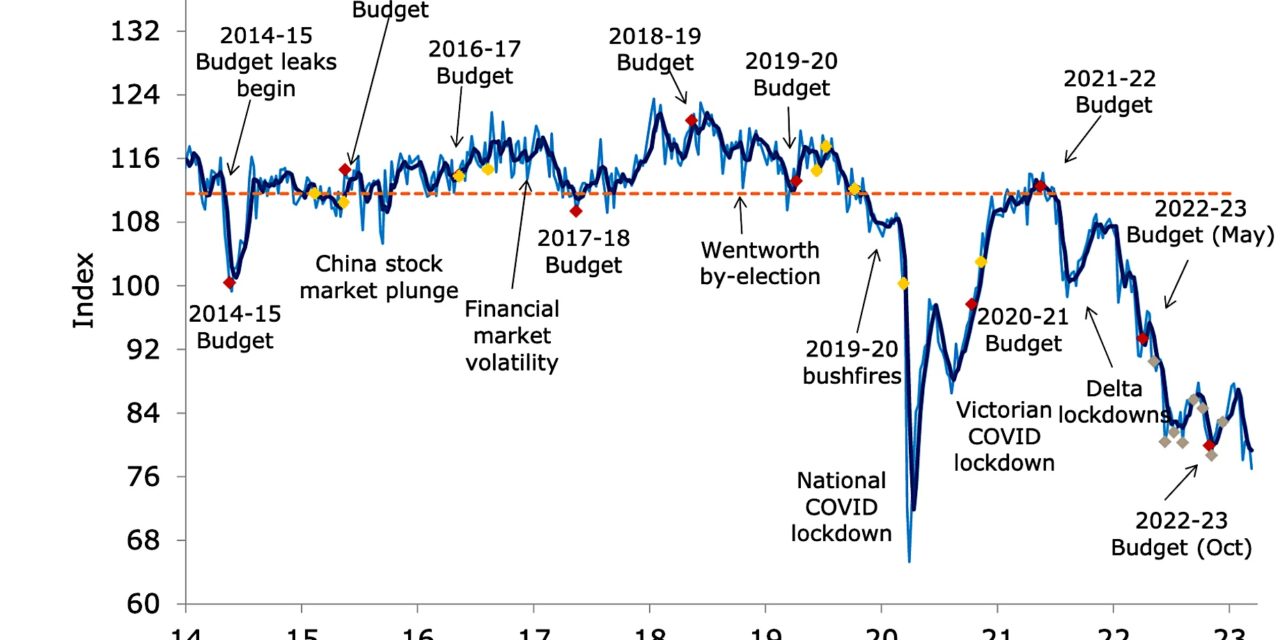

Australian consumer confidence has plunged to its lowest level since the Covid ‘national lockdown’ in April 2020 – following the Reserve Bank’s decision last week to impose a record 10th consecutive interest rate hike: up 0.25% to 3.6%.

Australian consumer confidence has plunged to its lowest level since the Covid ‘national lockdown’ in April 2020 – following the Reserve Bank’s decision last week to impose a record 10th consecutive interest rate hike: up 0.25% to 3.6%.

More Australians than at any other time in over 30 years now feel their families are worse off than they were in the previous year.

ANZ-Roy Morgan Consumer Confidence dropped by 2.9 points to 77.0 this week. Consumer Confidence is now 18.8 points below the same week a year ago, March 7-13, 2022 (95.8) and 5.7pts below the 2023 weekly average of 82.7.

Consumer Confidence often affects consumer spending, particularly on discretionary items, a category into which much leisure travel falls. Travel is resilient and airlines are charging relatively high fares – but like most spending, travel rides on the back of the general economy.

Consumer Confidence was down around the country this week and below 80 in all five mainland States. Views on personal finances deteriorated and were the driving force behind the decline in the weekly index, both compared to a year ago and looking forward over the next year.

The ANZ-Roy Morgan survey was conducted before confirmation yesterday that Australia will embark on a staggeringly expensive nuclear-powered submarine program, likely to cost an eye-watering A$368 billion, more than any major national infrastructure project.

The Treasury will have to find up to $31 billion in budget savings over the coming decade to offset the medium-term cost of the planned submarine fleet. Talk of belt-tightening and a decade of austerity has already begun.

The Australian share market sank again yesterday in the wake of the collapse of America’s Silicon Valley Bank. The effect – if any – on the same market by Australia’s submarine decision may surface today.

MEANWHILE, the insistence by certain media outlets that Australia faces likely war with China within the next three years is fuelling an atmosphere of anxiety and alarm which exerts a discouraging influence on people’s plans.

The gloomy view is by no means universal. Many analysts believe war with China is highly unlikely, particularly in such a short time-frame.

Current financial conditions

- Now less than one in five Australians (19%, down 2%) say their families are ‘better off’ financially than this time last year. Most Australians (52.2%, up 4%) say their families are ‘worse off’ financially (the highest figure for this indicator for over 30 years since March 1991 – 52.7%).

Future financial conditions

- Looking forward, under a third of Australians, 30% (down 2%), expect their family to be ‘better off’ financially this time next year while over a third, 37% (up 2%), expect to be ‘worse off’.

Current economic conditions

- Only 6% (unchanged) of Australians expect ‘good times’ for the Australian economy over the next 12 months compared to almost two-fifths, 38% (unchanged), that expect ‘bad times’.

Future economic conditions

- Sentiment regarding the Australian economy in the longer term remains very weak with only 11% (down 1ppt) of Australians expecting ‘good times’ for the economy over the next five years compared to 20% (up 3ppts) expecting ‘bad times’.

Time to buy a major household item?

- When it comes to buying intentions now 19% (unchanged) of Australians, say now is a ‘good time to buy’ major household items while over half, 53% (unchanged), say now is a ‘bad time to buy’.

“Consumer confidence dropped to its lowest level since April 2020, after the RBA announced a 25bp increase in the cash rate in March.” ANZ Senior Economist, Adelaide Timbrell, confirmed.

“The sharpest decline in consumer confidence was in the current finances sub-index, which dropped to its lowest since 2001. Confidence about future finances declined to its sixth-lowest since the Covid outbreak.

“Inflation expectations also increased post-hike, by 0.4pts. Confidence among those paying off their mortgages increased 1.7pts after a sharp drop last week and are still the least confident of the housing cohorts. Those who own their home outright and renters reported sharp decreases of 4.1pts and 7.9pts respectively.”

Written by: Peter Needham