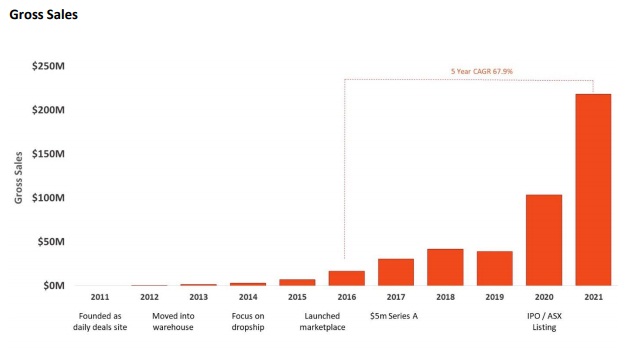

Commenting on the results, Sean Senvirtne, Founder & CEO of Mydeal.com.au, said: “After generating $218 million in Gross Sales, FY21 represents a significant moment in MyDeal’s history, a record 10 years in the making and just the beginning of what’s to come. As we cement ourselves as one of Australia’s most successful online retailers, I couldn’t be prouder of what the team has achieved. We have put ourselves in the perfect position to capture the increased demand in the market.

Underpinned by our ability to offer consumers great value across millions of home and lifestyle products, we have been able to execute our strong flywheel strategy to capture close to 900,000 active customers.

“Now with over 1,100 active sellers, 6+ million products and a private label business on a steep incline, we continue to entrench ourselves as one of Australia’s prominent online retail marketplaces for home and lifestyle products. We continue to scale by leveraging our proprietary technology across sellers, products and sales and continuously refining the user experience. We invest in efficient customer acquisition and retention strategies to accelerate active customer growth, while attracting marketplace sellers and investing in our private label offering to expand our range of products across in-demand categories.

“Gross Sales” or “Gross Transaction Value” (“GTV”) is a non-IFRS metric that represents the total value (unaudited) of transactions processed by MyDeal (including marketplace and private label), on a cash basis, before deducting refunds, chargebacks, discounts and coupons, but after deducting GST.

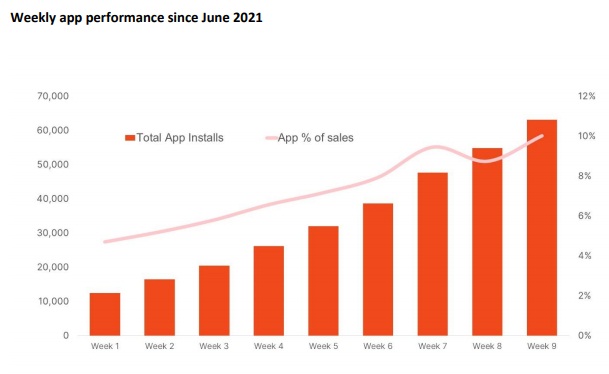

“Active Customers” are customers who have bought products through the MyDeal platform during the last 12 months. ”We achieved a key strategic milestone with the successful launch of our native iOS and Android mobile apps in May. With high ratings, high utilisation and strong conversion rates and more than 70k downloads, app already represents ~10%3 of Gross Sales, a number that continues to grow. Promoting and further optimising the app will remain a key feature of our strategy going forward.

“As more and more Australians make online shopping part of their everyday, we constantly work to improve and refine the MyDeal customer value proposition and continue to grow our loyal customer base. With new high calibre additions to the leadership and broader teams, a strong cash balance of $42.7 million, a revitalised brand on a journey to fame and industry tailwinds that drive demand, MyDeal is very well placed to expand on its market position for many years to come.” Gross Sales

Gross sales growth through record customer acquisition and strong retention The Company’s strategy in driving top line growth has predominately focused on a combination of new customer acquisition and customer retention. Both factors were evident in FY21 Gross Sales growth of 111% with 83% growth in active customers to 894,225 supplemented by a higher number of average orders per customer during the year. Customers now shop on average 1.7 times per year with MyDeal, up from 1.5 times in FY20.

Growing site visits, which averaged 6.4 million per month in FY21, continue to convert to transactions at a strong conversion rate. Following its launch in May 2021, conversion is proving particularly strong on the MyDeal iOS and Android mobile apps, with the app representing ~10%4 of sales. There remains significant opportunity to convert mobile website visits to app users.

3 For the week ended 15 August 2021

4 For the week ended 15 August 2021

Weekly app performance since June 2021

Improvement in purchase frequency is consistent with the increasing customer loyalty MyDeal experienced throughout the year, with the percentage of transactions from returning customers reaching 59.4% by Q4 FY21, up from 44.8% in Q4 FY20.

Private label supporting gross margins

On the supply side of the platform, a core focus during the year was the launch of the private label offering, as well as attracting additional sellers to the marketplace. The number of active marketplace sellers increased to 1,151 sellers as at 30 June 2021 (30 June 2020: 809).

After soft launching late in FY20, $8.8 million private label gross sales were achieved in FY21 (FY20: $0.3 million), with Q4 FY21 private label sales accounting for 5.2% of Gross Sales. Private label sales come at a significantly higher gross margin, which was 43.1% in FY21, which represents a strong margin expansion opportunity for MyDeal.

Gross profit as a percentage of net transaction value (NTV)

5 was stable overall, with marketplace commissions and private label margins in line with H1 FY21.

Investment for future growth

The Company’s successful listing on the ASX in October 2020, where it raised $40 million, provided the funds to execute MyDeal’s growth strategy. The $4 million EBITDA loss for FY21 (FY20: $0.7 million profit) primarily reflects the planned increase in advertising and promotional activity to support the Group’s focus on customer acquisition and launch of the private label business.

Marketing investment increased to 11.3% of NTV (FY20: 9.1%), reflecting the customer acquisition strategy. Importantly, last 12 month return on investment (ROI)

6 of 2.0 remains consistent with prior

5 Net Transaction Value (NTV) is Gross Sales or Gross Transaction Value after deducting refunds, chargebacks, discounts and coupons.

6 Last 12 month return on investment (ROI) is calculated as Gross Profit (GP) per Customer divided by New Customer Acquisition Cost (New CAC). GP per Customer is calculated as total Gross Profit for FY21 divided by the total number of customers that transacted in FY21. New CAC equals total marketing spend for FY21 x 51.8% (being the estimated percentage of marketing spent on new customer acquisition) divided by the number of new customers during FY21.

year, with higher average order values offsetting increases in customer acquisition costs. New customers continue to be profitable on their first purchase. While the Company continued to invest in technology, innovation and talent across the business, benefits of scale are evident in fixed costs reducing as a percentage of NTV to 4.5% (FY20: 5.6%).

The FY21 net cashflow from operations was an outflow of $3.9 million. Before private label inventory investment of $4.9 million, operating cash flow was positive ($1.0 million), reflecting the negative working capital marketplace model.

As at 30 June 2021, MyDeal had $42.7 million in cash and no debt, and remains well placed to pursue its growth strategy.

Outlook: positive start to FY22

FY22 has started strongly with positive growth for the first 8 weeks on the pcp, noting this is before the launch of the new multi-channel brand and advertising campaigns.

The Company remains focused on customer acquisition and retention, expanding its private label range and promoting its mobile apps for iOS and Android. With a refreshed brand strategy, marketing in FY22 will be broadened by channel and will include some above the line brand investment.

Australian ecommerce in the furniture and homewares category remains significantly underpenetrated by global standards, and MyDeal is well placed to benefit from rising penetration and to continue to drive market share gains going forward.

Results briefing session

CEO Sean Senvirtne, COO Joshua Mangan and CFO Lachlan Freeman will be conducting a results webcast for investors and analysts today at 12:00pm Australian Eastern Daylight Time.

To join the webcast please follow the link below:

https://services.choruscall.com.au/webcast/mydeal-210824.html

Alternatively, participants can choose to dial in to the call and can pre-register by navigating to the following link:

https://s1.c-conf.com/diamondpass/10015562-sy63gv.html

Annual Timetable

The Company advises that its annual general meeting will be held on 16 November 2021 and the closing date for the receipt of nominations from persons wishing to be considered for election as a director, is 28 September 2021.

Authorised for release by the Board of MyDeal.com.au Limited.