The latest data shows a two percent increase in weekly capacity with some 29.8 million scheduled seats this week representing a small but very important 600,000 more than the previous week. Pockets of growth occurring in eight of the 17 regional markets analysed. Total capacity is now at 29.9 million seats; some 80 million fewer seats than operated in the same week last year which highlights how far the global market has been impacted.

The latest data shows a two percent increase in weekly capacity with some 29.8 million scheduled seats this week representing a small but very important 600,000 more than the previous week. Pockets of growth occurring in eight of the 17 regional markets analysed. Total capacity is now at 29.9 million seats; some 80 million fewer seats than operated in the same week last year which highlights how far the global market has been impacted.

Interestingly, this time last week the forward-looking capacity suggested that some 32.3 million seats would be operated this week, that fell back by some 8% as airlines continue to make last minute adjustments to their schedules with less than a week’s notice. The forward looking capacity for next week now stands at 42.3 million; very close to the number reported a week earlier; it is very likely that whilst we may breakthrough the 30-million-mark next week, 42 million would be a step too far.

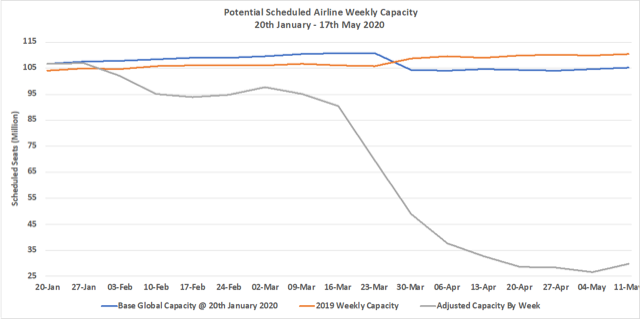

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

For some weeks North-East Asia has been showing signs of some recovery in capacity driven by the growth in Chinese capacity where a further one million domestic seats were added back this week to the schedules. Hong Kong was another market to report some positive news with Cathay Pacific adding back some 40,000 seats and growing frequency by some 120 flights over the seven days; at around eight round trip flights a day hardly earth shattering but nevertheless a positive step.

Similarly, from a small base, there are signs of recovery in South America, the North and South regions reporting double digit capacity growth on the previous week. Indeed, only one region, South Asia reports a double-digit decline amongst the top ten global regions and even here a potential reopening of domestic services in India before May 15 could see capacity bounce back next week.

Table 1 – Scheduled Airline Capacity by Region

Source: OAG

As a result of some 800,000 additional domestic seats being added in China the domestic share of global capacity has now crept up to 85% highlighting both the importance of air services in some markets and also where we should expect to see the initial signs of recovery. China’s domestic capacity stands at 75% of January’s level, the United States at 27% and Russia at 49% of pre COVID-19 levels. The UK level is now some 4%.