Post Views: 93

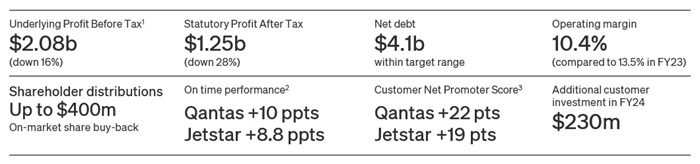

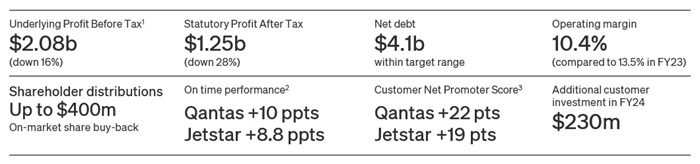

The Qantas Group has marked a significant milestone in its financial journey for 2024, recording an Underlying Profit Before Tax of $2.08 billion and a Statutory Profit After Tax of $1.25 billion.

The Qantas Group has marked a significant milestone in its financial journey for 2024, recording an Underlying Profit Before Tax of $2.08 billion and a Statutory Profit After Tax of $1.25 billion.

Press play to listen to this content

1x

Playback Speed- 0.5

- 0.6

- 0.7

- 0.8

- 0.9

- 1

- 1.1

- 1.2

- 1.3

- 1.5

- 2

spread the love the qantas group has marked a significant milestone in its financial journey for 2024, recording an underlying profit before tax of $2.08 billion and a statutory profit after tax of $1.25 billion. despite the challenging landscape marked by moderating fares, increased customer investments, and a dip in freight revenue, the group delivered strong earnings while focusing on its customers, employees, and shareholders. this comprehensive strategy demonstrates qantas’ robust business model and sets the stage for future growth in a competitive market. strategic financial performance. qantas group’s financial strength in fy24 is a testament to its well-integrated business portfolio, reflecting a clear focus on profitability, customer satisfaction, and sustainability. the group’s performance saw a slight reduction in overall earnings compared to the previous year, primarily due to market capacity normalization and increased customer-focused expenditures. however, the positive momentum in the second half, particularly in the domestic unit revenue, highlights the group’s ability to adapt and thrive in a dynamic environment. vanessa hudson, qantas group ceo, expressed confidence in the company’s direction, stating, “this result showcases the underlying strength of our integrated portfolio. we’ve seen significant benefits from increased corporate and resource travel, and ongoing high demand for international premium seats. jetstar has also delivered its highest result, meeting the growing demand from price-sensitive leisure travelers.”. operational excellence and customer commitment. throughout fy24, both qantas and jetstar achieved remarkable improvements in operational performance, which was reflected in heightened customer satisfaction levels. investments in operations, enhanced in-flight food and beverage offerings, and a comprehensive overhaul of qantas’ digital platforms have significantly bolstered the customer experience. the group’s fleet renewal program, which saw the addition of 11 new aircraft, further underscores its commitment to offering superior service, cost-efficiency, and environmental benefits. to acknowledge the dedication of its workforce, qantas extended a $500 travel voucher to 23,000 non-executive employees, adding to an earlier $500 voucher issued in february 2024. these gestures underline the group’s recognition of its employees’ crucial role in its success. fleet expansion: a pillar of future growth. the qantas group’s fleet renewal program, one of the most ambitious in its history, played a pivotal role in its fy24 success. the group introduced five jetstar airbus a321neo long range aircraft and two qantaslink a220s, with capital expenditure surging to $3.1 billion. these additions enhance operating cost efficiency, network flexibility, and passenger comfort while significantly reducing emissions. looking ahead, qantas plans to expand its fleet further, with 20 new aircraft set to arrive in the upcoming year and the return of two more a380s. this fleet growth is expected to provide a solid foundation for meeting the rising demand for domestic and international travel, mainly as australians prioritize travel over other spending categories. domestic and international performance: a balanced approach. in fy24, qantas group domestic delivered $1,361 million in underlying earnings with an ebit margin of 14%. qantas and jetstar’s dual-brand strategy drove this performance. jetstar’s domestic network expanded by 15% year-on-year, capitalizing on the strengthening demand for low-fare travel. in comparison, qantas’ capacity saw a modest 1% increase, fueled by a resurgence in corporate and small business travel. on the international front, qantas group international’s earnings moderated to $755 million underlying ebit as the return of global airline capacity put downward pressure on fares. however, the group’s strategic focus on key routes, such as perth-london and the new perth-paris service, inspires confidence in future expansions, including the much-anticipated non-stop flights to london and new york. jetstar’s international network also saw significant growth, achieving an 11% margin for the year. introducing new a321lr aircraft has allowed jetstar to expand its short-haul international routes, further solidifying its competitive leisure travel market position. qantas loyalty: driving engagement and value. qantas loyalty emerged as a critical driver of the group’s success, delivering a record underlying ebit of $511 million in fy24. the program saw unprecedented levels of engagement, with a record number of points earned and redeemed and a 14% increase in active members. introducing the classic plus flight rewards program, which unlocks millions of frequent flyer seats, has driven member engagement and program value. qantas loyalty’s strategic expansion into the holiday package market, highlighted by the acquisition of tripadeal, is expected to enhance its value proposition further. the acquisition is poised to create significant synergies, combining qantas and jetstar’s extensive network with the growing demand for curated tours. financial stability and shareholder returns. the qantas group’s financial framework underscores the importance of sustainable investments that drive customer satisfaction and shareholder value. as of june 30, 2024, the group held $10.2 billion in liquidity, with $1.7 billion in cash reserves. despite the significant capital outlays for new aircraft and employee bonuses, the group maintained a robust balance sheet with net debt at $4.1 billion, comfortably within the target range. looking forward, qantas has announced plans to distribute up to $400 million to shareholders through an on-market share buy-back in the first half of fy25, demonstrating its commitment to delivering long-term value to its investors. sustainability: leading the charge in decarbonization. qantas remains at the forefront of the aviation industry’s push towards sustainability, with a firm commitment to achieving net zero emissions by 2050. the group has substantially invested in decarbonization projects, including sustainable aviation fuel (saf) initiatives and nature-based carbon offset programs. in fy24, qantas renewed its saf purchasing agreement for flights out of heathrow and expanded its corporate customer saf program. the group’s ongoing advocacy for a domestic saf industry underscores its belief in sustainable aviation’s potential economic and environmental benefits. looking ahead: a stable outlook. as qantas group enters fy25, the outlook remains positive, with stable travel demand across its portfolio. group domestic unit revenue will increase by 2-4% in the year’s first half. in contrast, group international’s unit revenue is expected to face slight downward pressure due to the restoration of market capacity. however, the group anticipates a turnaround in international unit revenue by the fourth quarter, driven by continued demand for premium international travel. in summary, qantas group’s fy24 results reflect a solid and resilient business poised for continued growth and success. the group’s strategic investments in fleet renewal, customer experience, and sustainability are expected to yield long-term benefits for its customers, employees, and shareholders, solidifying its position as a leader in the global aviation industry. written by: karuna johnson. ===================================. tarik rahali joins al habtoor grand as revenue director. travelmanagers’ 2025 conference sets bold vision in bali. aer lingus & riverdance take flight in a new partnership! singapore airlines elevates dining with chef sid sahrawat. virgin australia 2025: on-time excellence soars even higher! lennon’s guest bartender series: craft cocktails & encounters! christian kimber teams with woodford: couture cocktail debut. east coast car rentals breaks ground on new hobart branch. city celebrates timeless photo ops: capture urban legacy! 1000mtg’s hong kong conference ignites new era for travel pros.

Despite the challenging landscape marked by moderating fares, increased customer investments, and a dip in freight revenue, the Group delivered strong earnings while focusing on its customers, employees, and shareholders. This comprehensive strategy demonstrates Qantas’ robust business model and sets the stage for future growth in a competitive market.

Strategic Financial Performance

Qantas Group’s financial strength in FY24 is a testament to its well-integrated business portfolio, reflecting a clear focus on profitability, customer satisfaction, and sustainability. The Group’s performance saw a slight reduction in overall earnings compared to the previous year, primarily due to market capacity normalization and increased customer-focused expenditures. However, the positive momentum in the second half, particularly in the domestic unit revenue, highlights the Group’s ability to adapt and thrive in a dynamic environment.

Vanessa Hudson, Qantas Group CEO, expressed confidence in the company’s direction, stating, “This result showcases the underlying strength of our integrated portfolio. We’ve seen significant benefits from increased corporate and resource travel, and ongoing high demand for international premium seats. Jetstar has also delivered its highest result, meeting the growing demand from price-sensitive leisure travelers.”

Operational Excellence and Customer Commitment

Throughout FY24, both Qantas and Jetstar achieved remarkable improvements in operational performance, which was reflected in heightened customer satisfaction levels. Investments in operations, enhanced in-flight food and beverage offerings, and a comprehensive overhaul of Qantas’ digital platforms have significantly bolstered the customer experience. The Group’s fleet renewal program, which saw the addition of 11 new aircraft, further underscores its commitment to offering superior service, cost-efficiency, and environmental benefits.

To acknowledge the dedication of its workforce, Qantas extended a $500 travel voucher to 23,000 non-executive employees, adding to an earlier $500 voucher issued in February 2024. These gestures underline the Group’s recognition of its employees’ crucial role in its success.

Fleet Expansion: A Pillar of Future Growth

The Qantas Group’s fleet renewal program, one of the most ambitious in its history, played a pivotal role in its FY24 success. The Group introduced five Jetstar Airbus A321neo Long Range aircraft and two QantasLink A220s, with capital expenditure surging to $3.1 billion. These additions enhance operating cost efficiency, network flexibility, and passenger comfort while significantly reducing emissions.

Looking ahead, Qantas plans to expand its fleet further, with 20 new aircraft set to arrive in the upcoming year and the return of two more A380s. This fleet growth is expected to provide a solid foundation for meeting the rising demand for domestic and international travel, mainly as Australians prioritize travel over other spending categories.

Domestic and International Performance: A Balanced Approach

In FY24, Qantas Group Domestic delivered $1,361 million in underlying earnings with an EBIT margin of 14%. Qantas and Jetstar’s dual-brand strategy drove this performance. Jetstar’s domestic network expanded by 15% year-on-year, capitalizing on the strengthening demand for low-fare travel. In comparison, Qantas’ capacity saw a modest 1% increase, fueled by a resurgence in corporate and small business travel.

On the international front, Qantas Group International’s earnings moderated to $755 million underlying EBIT as the return of global airline capacity put downward pressure on fares. However, the Group’s strategic focus on key routes, such as Perth-London and the new Perth-Paris service, inspires confidence in future expansions, including the much-anticipated non-stop flights to London and New York.

Jetstar’s international network also saw significant growth, achieving an 11% margin for the year. Introducing new A321LR aircraft has allowed Jetstar to expand its short-haul international routes, further solidifying its competitive leisure travel market position.

Qantas Loyalty: Driving Engagement and Value

Qantas Loyalty emerged as a critical driver of the Group’s success, delivering a record underlying EBIT of $511 million in FY24. The program saw unprecedented levels of engagement, with a record number of points earned and redeemed and a 14% increase in active members. Introducing the Classic Plus Flight Rewards program, which unlocks millions of frequent flyer seats, has driven member engagement and program value.

Qantas Loyalty’s strategic expansion into the holiday package market, highlighted by the acquisition of TripADeal, is expected to enhance its value proposition further. The acquisition is poised to create significant synergies, combining Qantas and Jetstar’s extensive network with the growing demand for curated tours.

Financial Stability and Shareholder Returns

The Qantas Group’s financial framework underscores the importance of sustainable investments that drive customer satisfaction and shareholder value. As of June 30, 2024, the Group held $10.2 billion in liquidity, with $1.7 billion in cash reserves. Despite the significant capital outlays for new aircraft and employee bonuses, the Group maintained a robust balance sheet with net debt at $4.1 billion, comfortably within the target range.

Looking forward, Qantas has announced plans to distribute up to $400 million to shareholders through an on-market share buy-back in the first half of FY25, demonstrating its commitment to delivering long-term value to its investors.

Sustainability: Leading the Charge in Decarbonization

Qantas remains at the forefront of the aviation industry’s push towards sustainability, with a firm commitment to achieving net zero emissions by 2050. The Group has substantially invested in decarbonization projects, including sustainable aviation fuel (SAF) initiatives and nature-based carbon offset programs.

In FY24, Qantas renewed its SAF purchasing agreement for flights out of Heathrow and expanded its corporate customer SAF program. The Group’s ongoing advocacy for a domestic SAF industry underscores its belief in sustainable aviation’s potential economic and environmental benefits.

Looking Ahead: A Stable Outlook

As Qantas Group enters FY25, the outlook remains positive, with stable travel demand across its portfolio. Group Domestic unit revenue will increase by 2-4% in the year’s first half. In contrast, Group International’s unit revenue is expected to face slight downward pressure due to the restoration of market capacity. However, the Group anticipates a turnaround in international unit revenue by the fourth quarter, driven by continued demand for premium international travel.

In summary, Qantas Group’s FY24 results reflect a solid and resilient business poised for continued growth and success. The Group’s strategic investments in fleet renewal, customer experience, and sustainability are expected to yield long-term benefits for its customers, employees, and shareholders, solidifying its position as a leader in the global aviation industry.

Written by: Karuna Johnson

===================================

The Qantas Group has marked a significant milestone in its financial journey for 2024, recording an Underlying Profit Before Tax of $2.08 billion and a Statutory Profit After Tax of $1.25 billion.

The Qantas Group has marked a significant milestone in its financial journey for 2024, recording an Underlying Profit Before Tax of $2.08 billion and a Statutory Profit After Tax of $1.25 billion.