As the year winds down and the Australian summer beckons, the focus shifts to holiday planning. But a surprising trend has emerged: despite the prevalence of airline and hotel loyalty programs, many Australian holidaymakers remain unaffected by these schemes.

As the year winds down and the Australian summer beckons, the focus shifts to holiday planning. But a surprising trend has emerged: despite the prevalence of airline and hotel loyalty programs, many Australian holidaymakers remain unaffected by these schemes.

Recent YouGov surveys have shed light on this intriguing behaviour. While nearly 60% of Australians are members of at least one airline loyalty program, and about 31% are affiliated with hotel loyalty clubs, these memberships don’t always dictate their travel choices.

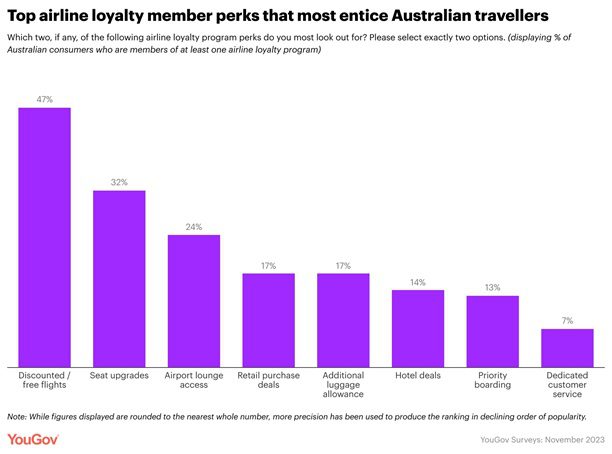

Qantas Frequent Flyer leads the pack for airlines, boasting membership from a third of Australians. Virgin Australia’s Velocity Frequent Flyer trails significantly. The perks of these programs are varied – discounted or free flights are a significant draw, as are seat upgrades and lounge access. Gender differences emerge in these preferences, with women valuing free flights and retail purchases more, while men lean towards hotel deals and priority boarding.

However, when it comes to making actual booking decisions, the influence of these loyalty programs wanes. Only 44% of loyalty members begin their international flight searches with affiliated airlines, and a mere 13% restrict their choices to these airlines. In contrast, 20% prioritize travel schedules before considering loyalty benefits. Notably, 30% of Australian travellers assert that their loyalty memberships do not sway their choice of international flights, with men more likely than women to start their search with preferred airlines.

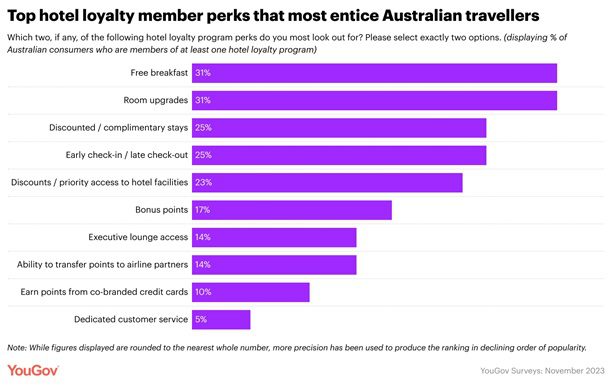

The hotel loyalty landscape is equally intriguing. Accor Live Limitless/Accor Plus is the most popular choice, followed by Hilton Honors, IHG One Rewards, and Marriot Bonvoy. Free breakfasts and room upgrades are the most sought-after perks, with a significant gender divide: women prefer free breakfasts and flexible check-in/out times, while men focus on bonus points and transferability to airline partners.

In booking accommodations, 31% of loyalty members start with hotels where they hold memberships, then consider price and location. However, 36% prioritize location, and 29% budget before loyalty benefits, with men again more likely to begin with preferred hotels.

This data reveals a nuanced picture of Australian travellers’ habits. While loyalty programs offer enticing benefits, they are not the primary factor in holiday decision-making for many. As the travel landscape evolves, understanding these preferences becomes crucial for industry players aiming to cater to the diverse needs of Australian tourists.

For more insights, visit YouGov’s business sector website.

Written by: Jill Walsh