In the labyrinth of the travel industry’s resurgence, a phoenix has risen with unparalleled vigour – the cruise sector, painting a vivid canvas of revitalization and adaptability. Unravelling the threads of this impressive comeback story is InsureandGo’s latest revelation, showcasing a staggering 96% hike in cruise travel insurance acquisitions by Australian explorers from the June-December horizon of 2022, stretching to January-July in 2023. August of 2023 alone witnessed a monumental 336% leap from its counterpart in 2022, etching a historic moment in the travel insurance chronicles.

In the labyrinth of the travel industry’s resurgence, a phoenix has risen with unparalleled vigour – the cruise sector, painting a vivid canvas of revitalization and adaptability. Unravelling the threads of this impressive comeback story is InsureandGo’s latest revelation, showcasing a staggering 96% hike in cruise travel insurance acquisitions by Australian explorers from the June-December horizon of 2022, stretching to January-July in 2023. August of 2023 alone witnessed a monumental 336% leap from its counterpart in 2022, etching a historic moment in the travel insurance chronicles.

This crescendo in insurance uptake does not sing a solo. It resonates harmoniously with the international crescendos forecasted by the esteemed Cruise Lines International Association (CLIA), painting 2023, which is set to embrace 106% of 2019’s cruise passenger volumes, totalling a formidable 31.5 million sea voyagers. A stark contrast paints itself when placed beside international tourism’s pace, with the World Tourism Organization projecting a slower climb back to 80-95% of 2019’s glory.

Jonathan Etkind, the seasoned Chief Commercial Officer and spokesperson of InsureandGo, lends his expertise, stating, “These forecasts, dovetailed with our insightful insurance purchase data, unravel the indelible legacy of COVID-19. Cruises, with their unique milieu and inherent risks, bore the pandemic’s brunt in ways unparalleled.”

Princess Cruises is a testament to this resilience and innovation, fortifying its defence against viral threats with enhanced air filtration and upgraded HVAC systems, ensuring fresh air for every voyager every five to six minutes.

Etkind reflects on the journey from the ban’s lift in April 2022 to the axing of COVID-19 cruise protocols by the NSW Government in August 2023, highlighting this pivotal period as a catalyst for the surge in cruise popularity and subsequent insurance uptake.

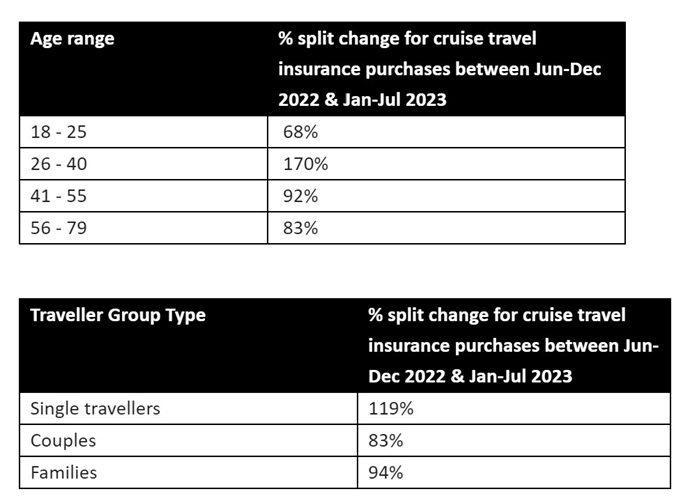

But the plot thickens. InsureandGo’s data lays bare a fascinating demographic shift. The age bracket of 26-40 witnessed a 170% surge in cruise insurance engagement, while single travellers of all ages showed a 119% uptick. This is a silent nod to the industry’s conscious efforts at diversifying appeal, epitomized by entities like Virgin Voyages and Disney Cruises, catering to an eclectic audience with offerings ranging from tattoo parlours to HIIT workout classes.

Yet, as the cruise sector basks in this uptrend, domestic insurance purchases tell a different tale, with a 22% dip in the same timeframe. Etkind attributes this to rejuvenating confidence in domestic travel, borne out of the tribulations and transformations experienced by local travel providers amidst the havoc of the pandemic.

As the travel tapestry continues to evolve, this surge in cruise travel insurance uptake stands as a beacon, illuminating the path of the Australian traveller’s resurgence, adaptability, and unyielding spirit, sailing confidently into a future brimming with potential and promise.

Written by: Charmaine Lu