![]() The U.S. vacation rental industry is grappling with a harsh summer, marked by a significant 17% drop in Revenue Per Available Rental (RevPAR), as detailed by the leading short-term rental analytics firm Key Data.

The U.S. vacation rental industry is grappling with a harsh summer, marked by a significant 17% drop in Revenue Per Available Rental (RevPAR), as detailed by the leading short-term rental analytics firm Key Data.

Europe and the UK didn’t remain unaffected. Both regions registered noticeable downturns during June, July, and August. However, the U.S. scenario looked grimmer with its sole decline in Average Daily Rates (ADR) in sheer numbers.

Shedding light on the figures, the RevPAR in the U.S. plummeted 14.1%, translating to $115. When we bring inflation into the picture, this reflects a 16.8% downturn. Simultaneously, the ADR nosedived 8.1% year-on-year, slipping from $328 to $302 – a tangible dip of 11% in real terms. Paid occupancy wasn’t spared, either, seeing a 6.5% drop, ending at a sombre 38%.

Positioning this against a global backdrop reveals a more distressing narrative for the U.S. While the European and UK markets showed resilience, albeit slowly, the U.S. outpaced both in its downward trajectory. U.S. RevPAR dwindled over twice as swiftly as its European and UK counterparts. Consequently, American property managers now find themselves in a crucible, desperately defending their revenue streams.

Contrarily, Europe displayed a modest uptick in ADRs by 0.3% in real terms, reaching $182, somewhat counterbalancing an 8.2% dip in summer occupancy. As a result, European RevPAR took an 8% hit, settling at $71. Over in the UK, RevPAR shrunk by 6% in real terms to $86, compounded by a 2.4% decrease in occupancy and ADRs dwindling by 3.6% to reach $213.

On the global stage, RevPAR suffered a 9.8% cut to stand at $705, with factors like a 4.9% real-term decline in ADR during the peak summer months and a 5.1% annual reduction in occupancy amplifying the revenue downfall.

Key Data’s methodology is noteworthy as it gleans direct insights from property managers and integrates millions of data points from online travel agents like Airbnb and Vrbo. Their nuanced approach factors in periods when bookings are paused for maintenance or owners’ personal stays.

Venturing into projections for the rest of 2023, based on preliminary figures as of August-end, the U.S. RevPAR looks set to experience a $20 year-on-year drop. Occupancy also seems to be downward, trailing by six percentage points. Nonetheless, there’s a glimmer of hope, with ADRs poised to rise by 0.9%.

Interestingly, U.S. booking timelines have contracted by 11.4% year-over-year for the September-December window – a decline from 68 to 60 days. This might present a window of opportunity for property managers to regain lost ground.

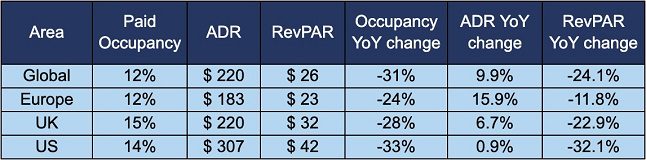

Across the pond, the UK’s RevPAR for the upcoming months trails by 22.9%, despite ADRs seeing a 6.7% surge to $220. Occupancy, however, lags by a significant 28%. Europe echoes this sentiment with a milder RevPAR dip of 11.8%, ADRs rising by 15.9%, but occupancy lagging by 24%. As we draw a global comparison, worldwide occupancy rates have dipped by 31% from the same period in the previous year, causing a RevPAR decrease of 24.1%, even with ADRs climbing by 9.9%.

Jason Sprenkle, the helm of Key Data, reflected on this tumultuous phase, stating, “A considerable chunk of U.S. property managers probably faced disappointment this past summer. While global RevPAR saw downturns, the U.S. might witness some sunshine in 2024.” He attributed the revenue dent to the escalating cost-of-living crisis and a swelling inventory of short-term rentals. Sprenkle added, “The forthcoming months remain shrouded in uncertainty. However, we do anticipate a dip in global occupancy.”

To dive deeper into these insights, visit keydatadashboard.com.

Written by: Matthew Thomas