Qantas says strong travel demand is accelerating its recovery from the Covid crisis, enabling it “to keep investing for customers and its people” while also strengthening its balance sheet.

Qantas says strong travel demand is accelerating its recovery from the Covid crisis, enabling it “to keep investing for customers and its people” while also strengthening its balance sheet.

The Qantas Group, which released a million domestic sale fares yesterday, also says its performance is steadily improving.

In short, according to a bulletin yesterday:

-

-

- Group expects 1H23 Underlying Profit Before Tax of between $1.2 billion and $1.3 billion.

- Operational performance continues to improve; Qantas back at or around pre-Covid service levels in first half of October.

- Further $200 million investment in continued operational resilience against sick leave spikes, supply chain delays.

- Accelerated financial recovery enables improvement to wages policy at total cost of approximately $40 million p.a.

- Translates to additional pay increase for around 20,000 employees on top of $10,000 in bonuses and improvement to staff travel benefits.

- Over 1 million domestic sale fares released today by Qantas and Jetstar.

-

Domestic travel demand remains strong across all categories. Revenue intakes for business purposes are over 100% of pre-Covid levels and leisure intakes have further strengthened to over 130%, the carrier says.

“Yields from international markets are particularly strong but are expected to moderate as Qantas and other carriers steadily increase capacity.

“Qantas Loyalty expects to post record earnings for the first half and is on track to reach its FY23 EBIT target of $425–$450 million.

“The broader operating environment remains complex with high fuel prices and high inflation, as well as higher interest rates impacting on consumer confidence. However, robust demand indicates that people are prioritising spending on travel above other categories, which supports the Group’s ability to fully recover higher fuel costs through fares. Fuel prices are now around 75% higher than pre-Covid, compared with around 60% in August 2022.”

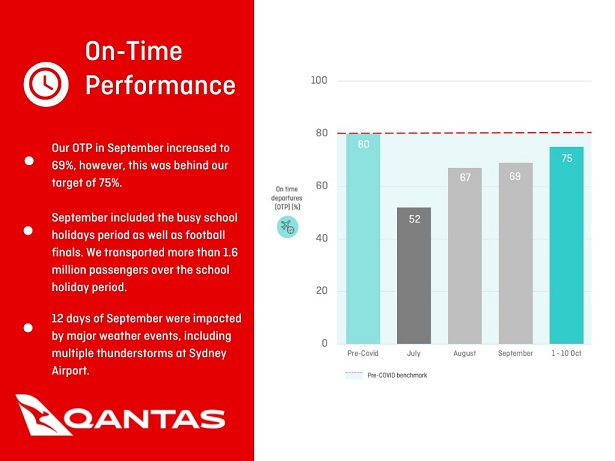

The carrier says its operational performance has continued to improve towards pre-Covid levels, despite some extreme weather events on the east coast, air traffic control limitations and a busy school holiday period nationally.

“Qantas Domestic’s on time performance increased from 67% in August to 69% in September, finishing ahead of its main competitor. While this is below the 75% target for some of the reasons mentioned above, performance in October has so far averaged 75% despite a 4% impact from continued extreme weather conditions.

“Qantas’ cancellations fell from 4% in August to 2.4% in September. In October so far, only 1.7% of flights have been cancelled, which is market leading and better than pre-Covid levels. Mishandled bags remained low at 6 per 1000 passengers in September and into October.”

“Jetstar’s performance in September suffered significantly from six of its 11 wide-body aircraft being out of service simultaneously as a result of several lightning strikes, a bird strike, damage from runway debris and challenges with global supply chains for replacement parts. These aircraft have since returned to service; Jetstar’s domestic and international performance have stabilised significantly in October, with further improvements expected in November.”

Qantas Group chief executive, Alan Joyce, said: “It’s been a really challenging time for the national carrier but today’s announcement shows how far we’ve come.

“Since August, we’ve seen a big improvement in our operational performance and an acceleration in our financial performance.

“It’s clear that maintaining our pre-Covid service levels requires a lot more operational buffer than it used to, especially when you consider the sick leave spikes and supply chain delays that the whole industry is dealing with. That means having more crew and more aircraft on standby and adjusting our flying schedule to help make that possible, until we’re confident that extra support is no longer needed.

“Qantas’ operations are largely back to the standards people expect, and Jetstar’s performance has improved significantly in the past few weeks and will keep getting better with the extra investments we’re making.

“The fact our financial recovery has accelerated means we can invest more in rewarding our employees, who are doing an amazing job. We’ll spend an additional $40 million a year on permanent pay increases for our people on top of the $200 million in cash and share bonuses we’ve announced for our people.”

Commenting on the Qantas Group’s FY23 update, Steve Johnson, Chief Investment Officer at Forager Funds Management said:

“It was a big Qantas update this morning. They are saying their profit for the six months to December will be almost as much as the market was assuming they would make for the full year, and forward bookings look even better Jan through June.

“Qantas’ update this morning confirms Forager’s thesis that pent up travel demand is offsetting any consumer weakness.

“The restructuring and efficiency gains made during Covid have been underestimated by the market.

“We think there is clearly some short-term tailwinds here but that the longer-term company and industry structure is going to be far more sustainable too.”

Qantas Group is a holding within the Forager Australian Shares Fund. Forager Funds Management runs two funds on behalf of retail investors – an Australian Shares Fund and an International Shares Fund, it said yesterday

MEANWHILE, more than one million heavily discounted airfares for flights across Australia are up for grabs with Qantas, QantasLink and Jetstar today launching the biggest combined Qantas Group domestic flights sale of the year.

The number of points required to book reward seats has not increased since 2019.Over the past year, almost 10 per cent of passengers carried by Qantas travelled on a reward seat.

Edited by Peter Needham