Thai International (THAI) on 19 May confirmed it would file under chapter 3/1 of the bankruptcy law for protection while it goes through a court-supervised reform plan.The Thailand government will give up its controlling stake in Thai Airways as it approved a financial restructuring for the cash-strapped airline through bankruptcy protection.

Thai International (THAI) on 19 May confirmed it would file under chapter 3/1 of the bankruptcy law for protection while it goes through a court-supervised reform plan.The Thailand government will give up its controlling stake in Thai Airways as it approved a financial restructuring for the cash-strapped airline through bankruptcy protection.

The airline has made repeated annual financial losses and its financial health has only got more perilous since the global Covid-19 pandemic.

“The Cabinet agreed the government will reduce its holding in Thai Airways to under 50 per cent, ending the airline’s status as a state-enterprise,” said transport minister Saksayam Chidchob. Although insiders believe other branches of the government will hold small blocks of shares that will still take the government total over 50 percent shareholding. The unions have largely supported news of the restructure but are concerned about the reduced shareholding by the state, as they fear a further reduction will be disadvantageous for their members’ state benefits.

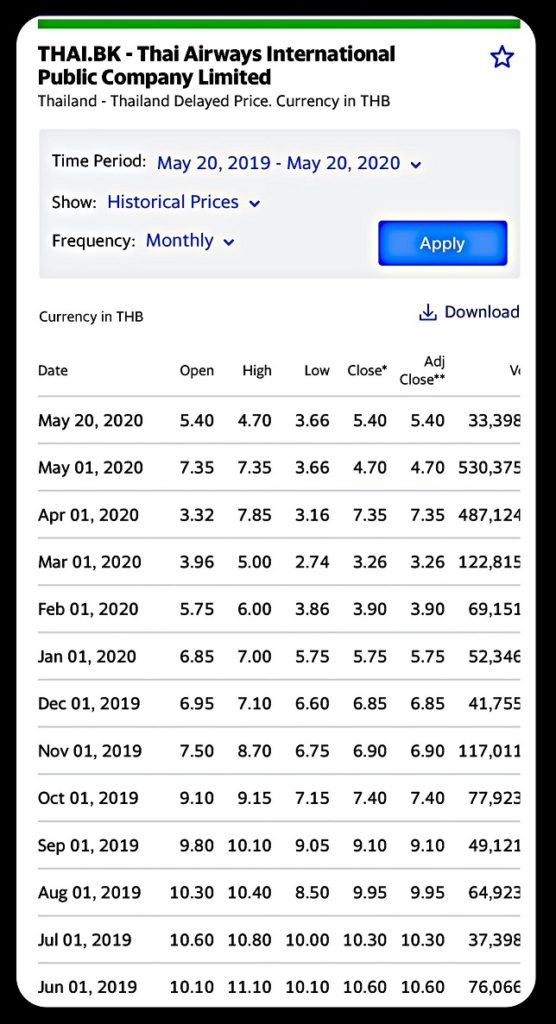

After huge losses in 2019 and a 90 percent drop in its share price since 1999, the government now plans to offload stock and distance itself. The losses sustained by the carrier have been staggering. In 2019 alone, it lost ฿12 billion.

After huge losses in 2019 and a 90 percent drop in its share price since 1999, the government now plans to offload stock and distance itself. The losses sustained by the carrier have been staggering. In 2019 alone, it lost ฿12 billion.

With disastrous future forecasts looming there is an urgency for the government to distance itself from the airline, it is after-all the airline’s financial backer of last resort. They cannot be happy with this year’s projected losses for the first six months of a catastrophic ฿18 billion.

The airline faced a cash crisis this month and had to conserve cash flow in other to meet its payroll commitments.

Of course, what kept the airline flying for so long has been the fact that it was majority owned by Thailand’s Ministry of Finance 51 percent. Howwever with debts of ฿92 billion mostly to the Thai bond market the Bangkok based credit rating agency downgraded the airline’s bonds from A to a BBB rating.

Part of the restructure plan will see a shrinking of its fleet over time (currently 74 aircraft) and leased aircraft being returned, which may lead to a future downsizing of the workforce.

Even as the national flag carrier strives to come up with a blueprint for financial recovery, the airline received further bad news. Thaiger.com reported that Airbus is calling in its debts on 30 aircraft rented by the airline. Thailand’s deputy transport minister says the company’s debts were checked on May 15, when documents showed that Airbus is trying to collect debts for rental of 30 airplanes as the due date draws near.

The government has supported the beleaguered carrier for 5 years, but it has failed to solve its financial issues, so the bankruptcy procedure is now the best option, according to the deputy minister, who says after the Finance Ministry sells its majority stake, the company will no longer be a state enterprise and will be easier to handle. The recovery plan must also be filed with the US bankruptcy court to prevent American creditors from seizing all the planes or collecting the airline’s assets.

Thaiger.com reported that 53 Airbus aircraft are on loan to Thai Airways and comprise of:

▫️15

▫️20

For now its few assets are protected from creditor demands although it is mulling whether it will need to seek bankruptcy protection not just in the US but also elsewhere overseas.

Limited domestic flights have restarted in Thailand but international services are still grounded until the end of June due to corona virus fears.

The restructuring effectively means that from now on, Thai Airways is flying solo (pun intended), without government support and will have to adapt to commercial realities.

The restructuring effectively means that from now on, Thai Airways is flying solo (pun intended), without government support and will have to adapt to commercial realities.

This crisis promises a return to a less nationalistic and more globally inspired world, we are also witnessing governments reassessing issues to do with national security.

It is not at all clear what sort of market Thai Airways will be flying back into, assuming that is the company manages to complete a successful and sustainable transformation.