COVID-19: Insights on Travel Impact, APAC

In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period and be prepared for the recovery once the situation stabilises.

Since the last edition of our APAC findings, we have had more countries in the region closing borders and implementing stricter control measures. With our access to real-time traveller audiences and unmatched visibility into global travel demand, Sojern is in a unique position to share current travel trends at the forefront of marketers’ minds. Our data can provide some insight into how travellers are responding to the current situation, the impact that COVID-19 will have on destinations, and when the first signs of recovery start to appear.

This week’s APAC trends include – Singaporeans continuing to show a demand for staycations, South Koreans demonstrating a readiness to travel, domestic travel trends within Asia Pacific, Chinese recovery patterns and finally, where travellers are dreaming to be.

These insights are based on data collected on the 31st March, 2020. We will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. For a deeper understanding of this week’s trends read more:

Singaporeans Showing Demand for Staycations

Year Over Year Change in Singapore Hotel Search and Bookings

Source: Sojern Hotels/OTA/Meta Data, Hotel searches January 5 to March 28, 2020 vs January 6 to March 31, 2019

Year Over Year Change in Singapore Hotel Check-In Dates, Based on Searches in March

Source: Sojern Hotels/OTA/Meta Data, Hotel searches March 1 to March 28, 2020 vs March 3 to March 31, 2019

While the international search for hotels in Singapore is low, Singaporeans are searching for staycations twice as much as compared to the same time last year. Although there is interest from the local market, the actual booking rate remains lower than last year, indicating that Singaporeans are adopting a wait-and-watch approach. On a week on week comparison, we are seeing more searches on staycations this week than the previous week for check in dates at hotels within the next two months. Notably, the past week’s searches are almost three times more as compared to last year.

South Koreans Demonstrating Readiness to Travel

Year Over Year Change in South Korea Hotel Search and Bookings

Source: Sojern Hotels/OTA/Meta Data, Hotel searches January 5 to March 28, 2020 vs January 6 to March 31, 2019

Year Over Year Change in South Korea Hotel Check-In Dates, Based on Searches in March

Source: Sojern Hotels/OTA/Meta Data, Hotel searches March 1 to March 28, 2020 vs March 3 to March 31, 2019

There are signs of recovery in South Korea over the past one month, as we see domestic searches and bookings bouncing back up slowly for check-in dates at hotels within the next two months. This coincides with the tapering of cases reported in South Korea from the 11th March onwards. As South Korea continues to tighten their border for all overseas arrivals, this can help to instill confidence in South Koreans to travel locally. Domestic searches for hotels are nearly back to last year’s figures, and bookings are increasing since the week of 23rd February. When looking at a week on week comparison, we see the domestic market increasingly searching for a staycation with a check-in date occuring within the next 2 months.

Domestic Travel within Asia Pacific May Increase

Year Over Year Change in Japan/Australia/New Zealand/Thailand Domestic Flight Search, based on past 2 weeks (15 March 2020 to 28 March 2020)

Source: Sojern Flight (Airline/OTA/Meta) Data, Flight searches, March 15 to March 28 2020 vs March 18 to March 31 2019

For larger Asia Pacific markets, we dig deeper to see if there are any positive signs within the domestic market for air travel. We do find that in the past 14 days, Thailand, New Zealand, Australia, and Japan have an increase in domestic flight searches for immediate travel in the month of March. While we cannot confirm that these are signs of domestic travel for pleasure or those heading back to their hometown within the country, we will continually monitor this trend for the next few weeks.

Chinese Travellers Starting to Plan for Leisure Travel

Top 10 travelling weeks from China to International Markets, based on past week (22 March 2020 to 28 March 2020)

Source: Sojern Flight (Airline/OTA/Meta) Data, Flight searches and bookings, March 22 to March 28 2020

Last we had seen an increase of last minute, one-way tickets, but no overall trending uptick. We had also seen a higher than normal flight searches as Chinese citizens departed other regions with growing infection numbers. This week, this seems to have settled down, showing some signs of stabilisation.

Chinese travellers are also showing signs of confidence to travel internationally and we can see that they are starting to search for travel for Chinese New Year on 12-13 February 2021. There are also a good number of searches and even bookings for China’s National Day happening from 1-3 October 2020 – later this year!

From Dream to Destination

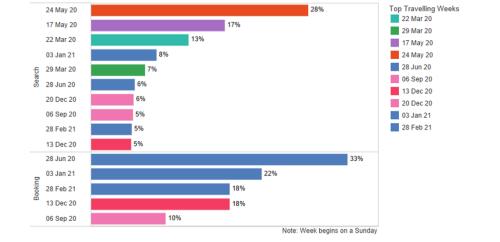

Top 10 travelling weeks to Maldives based on past week (22 March 2020 to 28 March 2020)

Source: Sojern Hotels/OTA/Meta Data, Hotel searches and bookings, March 22 to March 28 2020

The Maldives announced that it would be banning all tourist arrivals from Friday, March 27, so even though the country is on lockdown, it is interesting to see the potential of travellers looking to visit the dream destination in the near future. Hotels in Maldives are seeing searches from June 2020 onwards with a huge uptake for Q1 2021. More so, a majority of these bookings are seen to be coming from the United States.

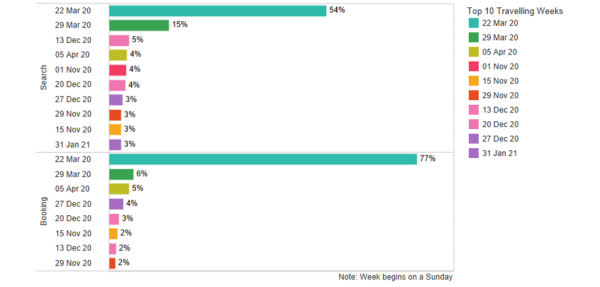

Top 10 travelling weeks to New Zealand based on past week (22 March 2020 to 28 March 2020)

Source: Sojern Flight (Airline/OTA/Meta) Data, Flight searches and bookings, March 22 to March 28 2020

Another unique finding has been destination New Zealand which is seeing inbound bookings later this year from late Q4 onwards, with searches for travel dates from 1st November 2020 to end of the year. New Zealand has put in aggressive and necessary containment policies in place with the hope to beat the spread of the virus faster than any other country.

There is no doubt that marketers around the world will have to adjust their marketing strategies over the coming months. We’ll continue to share more insights as we monitor the situation and provide recommendations in this blog series. For the rest of the COVID-19 insights series click here.