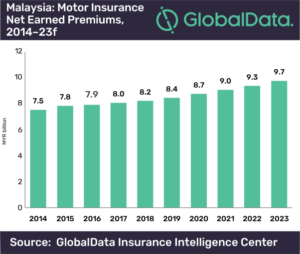

The motor insurance business in Malaysia is projected to grow from MYR8.2bn (US$2.0bn) in 2018 to MYR9.7bn (US$2.4bn) in 2023, in terms of net earned premium (NEP), according to GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Malaysia General Insurance: Key Trends and Opportunities to 2023’, reveals that motor insurance, one of the compulsory insurance classes, is a key driver of the total Malaysian general insurance business. It contributed 56% of the total general insurance NEP, as of end-2018.

Priyadarshini Ganai, Insurance Analyst at GlobalData, comments: “A key factor shaping the market is liberalization in motor insurance product pricing – with the first phase completed in 2016 followed by the next ongoing phase since 2017. It allowed market-based pricing of comprehensive and third-party insurance policies besides enabling new product offerings. In 2019, there were 66 new product launches in motor insurance – highest among all lines of general insurance business.”

De-tariffication in motor insurance enabled introduction of consumer risk-profile based policy pricing. This decreased average premium prices, benefiting existing and potential customers.

But profitability is a challenge in this industry. Insurers face escalating claims on account of rising motor accident and fraudulent claims. As per the General Insurance Association of Malaysia, Motor insurance claims amounted to MYR14.9mn per day, in the first half of 2019. As a result, insurers are seeking technology solutions to improve efficiency.

Ganai concludes: “The General Insurance Association of Malaysia’s stated goal is to reduce motor accidents by 50% in collaboration with the Ministry of Transport. For insurers, this will help reduce claims and improve profitability. Furthermore, motor insurers could look forward to a better business environment as pricing gets completely liberalized by the end of 2020.”