For an industry that prides itself on excess, luxury hospitality has spent the better part of a decade trying to remember how to behave.

Bigger was meant to be better. Louder meant relevance. Somewhere along the way, infinity pools multiplied, lobbies grew cavernous, and the word “immersive” was applied to anything that involved a scented candle and a marketing budget.

Then came a correction.

The World’s Best New Luxury Hotels of 2025, released this week by Luxury Travel Intelligence (LTI), reads less like a celebration of extravagance and more like a quiet memo to investors: discipline is back. So is judgment. And if you are going to spend north of a billion dollars restoring a palace, it had better feel like it means something.

No brand understood that better this year than Rosewood.

Rosewood’s Three-Win Year Is No Accident

Luxury hotel brands do not usually dominate LTI’s list. It is designed to resist exactly that sort of brand creep. Yet Rosewood has placed three properties in the 2025 rankings, including the overall winner, a first in the index’s history.

That alone tells you something structural is happening.

Rosewood has spent the past decade doing what many competitors found uncomfortable: slowing down. It has resisted scale for scale’s sake, leaned heavily into adaptive reuse, and invested in properties that take years, sometimes decades, to gestate.

The standout is The Chancery Rosewood in London, crowned World’s Best New Luxury Hotel 2025. Opening an ultra-luxury hotel in London is an exercise in humility. The city does not need you. It barely notices you. If your product is anything less than exceptional, it will quietly fail while remaining fully booked.

The Chancery succeeds not because it is flashy, it is not, but because it understands the economics of modern luxury: all-suite inventory, diversified food and beverage revenue, and a wellness offering (the Asaya Spa) that functions as a destination rather than an amenity.

That same logic underpins Rosewood Mandarina in Mexico and Rosewood Courchevel, both of which appear on the list for different reasons but share the same DNA: deep location specificity and a refusal to rush.

Luxury Is Shrinking – By Design

One of the quiet themes running through the 2025 list is intentional smallness.

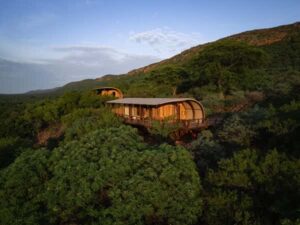

Consider Few & Far Luvhondo in South Africa. Six suites. That is the entire proposition. Spread across 100,000 hectares in the Soutpansberg Mountains, it is less a hotel than a land stewardship model with beds attached. This is luxury for guests who measure value in silence, not thread count.

The same logic applies to &Beyond Suyian Lodge in Kenya. Fourteen discreet suites, carefully positioned for privacy and sunrise views, with architecture designed to disappear rather than dominate. This is not scarcity theatre; it is operational restraint.

From a business perspective, these properties make sense. Smaller inventory reduces labour complexity, lowers reputational risk, and allows nightly rates that would be laughable in a 300-room resort. The margin story is not volume; it is conviction.

Urban Luxury Is Learning to Whisper Again

City hotels, once the loudest players in the luxury arms race, appear to be relearning the art of understatement.

Aman Bangkok, ranked third, is the clearest example. It is an urban hotel that behaves like a monastery. Courtyards soften the chaos, service anticipates rather than performs, and dining is offered quietly, almost reluctantly. This is Aman returning to first principles and being rewarded for it.

In Vienna, Mandarin Oriental’s Ringstrasse debut demonstrates similar restraint. Rather than stripping out history, the brand has doubled down on it, preserving Art Nouveau details and letting the building’s original grandeur do the work. Luxury, here, is confidence without commentary.

Even Faena New York, theatrical by nature, has tempered its instincts. Yes, there are pop-art murals and skyline views, but the underlying proposition is disciplined: limited keys, strong F&B identity, and a brand narrative that does not apologise for itself.

The Return of Adaptive Reuse

Perhaps the most reassuring trend for investors is the return of adaptive reuse as a luxury strategy.

Orient Express La Minerva in Rome is not merely a hotel opening; it is a signal. The brand’s decision to expand beyond trains into hospitality could have been gimmicky. Instead, it has chosen a historic palazzo near the Pantheon and invested heavily in craftsmanship rather than spectacle.

Likewise, Collegio alla Querce in Florence, once a Renaissance-era boarding school, has been reimagined by Auberge Collection with scholarly patience, Chapel, theatre, and gardens intact. Nothing rushed. Nothing flattened.

These projects are capital-intensive, slow, and politically complex. They are also defensible. In a market increasingly hostile to generic luxury, history is the last actual moat.

What the 2025 List Really Tells Us

Strip away the gloss and the awards dinners, and LTI’s 2025 list delivers a clear message to the industry:

-

Size is no longer the primary signal of success

-

Heritage beats novelty

-

Guests are better informed, less impressed, and quicker to disengage

-

Luxury must now justify itself economically and culturally

This is not austerity. It is maturity.

And in that sense, Rosewood’s standout year is less about domination than alignment. The brand has simply been preparing for this moment longer than most.

About Luxury Travel Intelligence

Luxury Travel Intelligence is an invitation-only organisation providing analysis and benchmarking for the global luxury hospitality sector.

Further information is available at: www.lti-members.com/invite-login.

Readers may use the Invitation Code: INVITE400, which includes a US$400 credit.

by Jason Smith – (c) 2025

Read Time: 8 minutes.

About the Writer.

Jason Smith has the kind of story you can’t fake, built on long flights, new cities, and that unmistakable hum of hotel life that gets under your skin and never quite leaves. Half American, half Asian, he grew up surrounded by the steady rhythm of the tourism trade in the U.S., where his family helped others see the world long before he did.

Jason Smith has the kind of story you can’t fake, built on long flights, new cities, and that unmistakable hum of hotel life that gets under your skin and never quite leaves. Half American, half Asian, he grew up surrounded by the steady rhythm of the tourism trade in the U.S., where his family helped others see the world long before he did.

Eager to carve out his own path, Jason packed his bags for Bangkok and the Asian Institute of Hospitality & Management, where he majored in Hotel Management and found a career and a calling. From there came years on the road, Singapore, Malaysia, Vietnam, each stop adding another thread to his craft.

He made his mark in Thailand, eventually becoming Director of Sales for one of the country’s leading hotel chains. Then came COVID-19: borders closed, flights grounded, and a new chapter began.

Back home in America, Jason turned his knack for connection into words, joining Global Travel Media to tell the stories behind the check-ins written with the same warmth and honesty that have always defined him.