Air travellers across the Asia-Pacific and Middle East are paying noticeably more to take to the skies this year; for once, it’s not the airports’ fault. A new report from the Airports Council International Asia-Pacific & Middle East (ACI APAC & MID), released this week in Hong Kong, paints a sober but revealing picture: airfares are climbing faster than passengers’ patience, while airport charges remain grounded mainly.

The findings, compiled with Flare Aviation Consulting, form part of the Airfare Trends 2025 report, which meticulously analyses fare movements since before the pandemic. The results show that while passenger numbers have rebounded strongly, ticket prices continue to soar, propelled by inflation and a shrinking field of airline competitors.

Inflation, Not Infrastructure, Is the Culprit

Between 2019 and 2025, average airfares across the Asia-Pacific region rose by 8%, reversing the 18% decrease recorded during the previous five-year period. The increase was even steeper in the Middle East, 15% higher than in 2019.

“Airfare variations are influenced by macroeconomic factors and airline competition, not airport charges,” the report notes, somewhat wearily. It’s a statement that airports have been repeating for years, often in the face of scepticism from politicians and passengers alike.

The data shows that airport charges and turnaround costs, including government taxes, have risen below the consumer price index (CPI). Those charges have decreased slightly in some markets, yet ticket prices still climbed. As ACI’s Director General Stefano Baronci put it bluntly, the message is clear: “Lowering airport charges does not translate into cheaper tickets.”

Baronci argues that doing so would only “limit airports’ ability to invest in capacity and technology to enhance service quality,” a warning that sounds remarkably prescient as air travel demand surges to near pre-COVID levels.

Oceania Tops the Fare Charts

Nowhere are passengers feeling the pinch more than in Oceania, where airfares have soared by nearly 30% above pre-pandemic levels, making it the most expensive region in the world to fly. The reasons are familiar: long distances, high operating costs, and few dominant carriers.

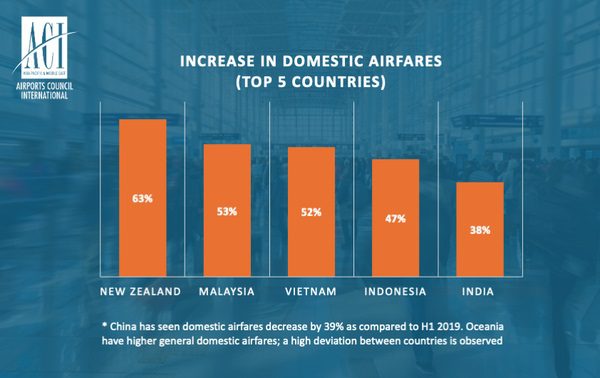

Southeast Asia isn’t far behind, with fares rising about 20% above 2019. Short-haul routes, once the playground of low-cost carriers, have seen the sharpest hikes. Reduced competition after airline consolidations has allowed remaining players to lift prices, often by 30% or more on some domestic legs.

By contrast, China and India have kept airfare levels below the regional average due to fierce domestic competition and government pressure to keep travel accessible. The US–China market has remained remarkably stable, showing no significant fare impact in 2025.

Business as Usual – But Pricier

The study found that international fares rose by about 17%, especially in developed East and Southeast Asia. Meanwhile, domestic fares jumped by over 30%, disproportionately affecting the economy-class traveller — the segment least likely to absorb rising costs.

“The biggest increases are being felt by economic travellers,” the report says, reflecting how leisure and family flyers have become collateral damage in a global cost-of-travel squeeze.

Routes with low airline competition recorded airfares up to 13 percentage points above the regional average, suggesting that consumers pay the price for a less crowded marketplace.

In markets like Australia and New Zealand, where airline duopolies effectively rule the roost, passengers discover that loyalty points might be the only affordable way to keep flying regularly.

The Misunderstood Role of Airports

One of the report’s central messages is aimed squarely at policymakers who blame airports for rising fares. In reality, airports’ contribution to ticket prices remains minor and falling. The report stresses that while charges account for only a small fraction of total airfare, those funds are crucial for future safety, sustainability, and passenger experience investments.

“Reducing airport charges only constrains the ability of airports to invest in capacity,” said Baronci. “To make air travel more affordable, governments should focus on liberalising markets, open skies, fair market access, and efficient slot policies that enhance airline competition.”

It’s a polite but pointed way of telling regulators to stop tinkering at the margins and tackle the fundamental structural issues.

Policy, Not Prices, Holds the Key

The ACI report underscores that airfare affordability is less about lowering airport fees and more about stimulating genuine airline competition. Liberalising airspace, simplifying slot allocation, and encouraging new entrants could have a far greater impact than token regulatory caps.

The report calls on policymakers to avoid “knee-jerk” measures that might feel consumer-friendly in the short term but undermine the long-term health of aviation infrastructure. After all, airports can’t build new runways, terminals, or sustainability upgrades on goodwill alone.

The message for governments keen to see cheaper tickets is unambiguous: focus on market liberalisation, not blame shifting.

Post-Pandemic Realities

Five years after the world’s biggest aviation shutdown, the skies are full again, but not always friendly. Airlines face higher fuel costs, staff shortages, and persistent inflation, all feeding into ticket prices. Passengers, meanwhile, are relearning an old truth: flying has never been cheap, and when it tries to be, something else pays the price, usually service quality.

As travel demand continues to rise across Asia-Pacific and the Middle East, airports are ready to invest in capacity and technology — provided they can.

“Airports are part of the solution, not the problem,” Baronci emphasised. It’s a reminder that behind every expensive seat is an ecosystem trying to keep pace with millions of travellers eager to get back in the air.