Spain’s vacation rental market has grown revenues this year but has been outperformed by its neighbor Portugal and the wider European market sparking a normalizing of nightly rates, short term rental (STR) data specialist Key Data says today1.

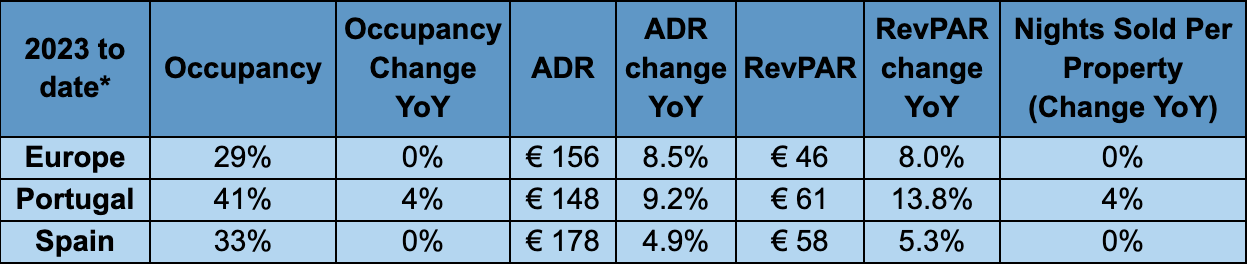

As part of a review of Spain’s short-term rental market, the company’s analysis reveals that, so far in 2023, short-term rental stays in Spain show a respectable 5.3% improvement in revenues. However, this trails the key local benchmark markets of Portugal and Europe as a whole where nightly rates are lower and more competitive.

In contrast, vacation rentals in Portugal have commanded a 13.8% improvement in RevPAR (Revenue per Available Rental) to €60.80, but here ADRs (Average Daily Rates) are significantly lower at €148 vs €178 in Spain. Nightly rates have risen 9.2% annually in Portugal while the number of nights sold has grown 4%.

As a consequence, occupancy in Portugal was also markedly higher than in Spain — 41% vs 33% — with 92 nights sold in Spain as managers entered the final quarter of the year1.

In Spain, RevPAR stood at €57.90 this year1 while the ADR improved by a more modest 5%. The fact ADR has increased in the face of a consumer spending squeeze indicates that demand remains strong but occupancy, as well as the number of nights sold, has remained flat year-on-year. Booking windows were also 5 days shorter in Spain at 60.3, compared with 65.1 days in Portugal.

The picture across Europe shows Spain has faced price pressure from elsewhere on the continent in 2023 too. Average ADRs for the whole of Europe sat at €156 (up 8.5% annually) leaving RevPAR up 8% at €45.70, with occupancy and nights sold flat year-on-year. Average booking windows were 5% higher at 60 days. The Eurozone’s annual rate of inflation fell to 4.3% in September2, meaning all three markets posted real terms revenue growth.

*Scraped vacation rental data from Airbnb & Vrbo, for stays Jan 1 to Oct 9 2023 vs 2022

Sally Henry, VP of Business Development EMEA at Key Data, said: “The key lesson for the tourism market in Spain is that, after periods of high demand, it can be difficult to react quickly enough to changes in demand. That’s when property managers are in danger of losing guests to competitors. This is what you can see playing out between these two ever popular neighbors, Portugal and Spain.

“The key difference between these markets is that, in Spain, tourists are being asked to spend 20% more on accommodation. That’s a serious factor for many consumers at a time when their wallets are being squeezed. For the short term rental industry in Spain to remain competitive, we are naturally going to see a further normalizing of nightly rates between now and next summer’s peak season. Property managers need to be proactive and get ahead of this if they want to make the most of the demand that is out there.”