![]() Visa’s Australia Spending Momentum Index (SMI) reveals that consumer spending habits in Australia continue to be influenced by shifts in inflation, interest rates, and the government’s COVID-19 response. In March, the overall SMI declined by 0.8 points to 93.6, reflecting a significant change in spending behaviour.

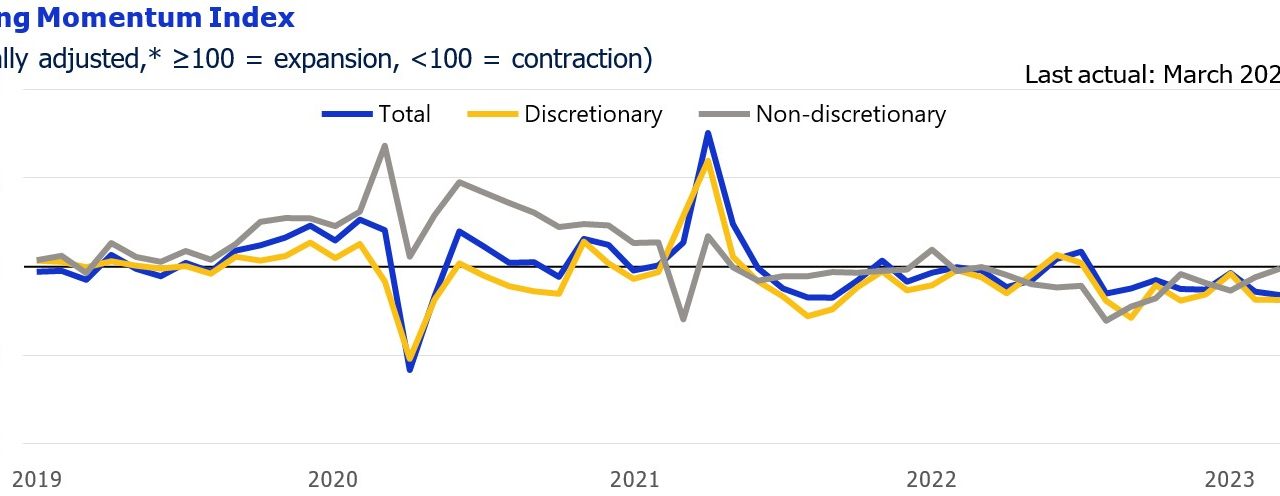

Visa’s Australia Spending Momentum Index (SMI) reveals that consumer spending habits in Australia continue to be influenced by shifts in inflation, interest rates, and the government’s COVID-19 response. In March, the overall SMI declined by 0.8 points to 93.6, reflecting a significant change in spending behaviour.

According to the index, consumers are moving away from discretionary spending and focusing on non-discretionary spending. This trend is driven by the impact of inflation and unemployment, magnified by the Reserve Bank of Australia’s decision to raise interest rates in May 2022 to contain inflation. While inflation has slightly decreased, unemployment has declined more, resulting in a stronger focus on non-discretionary spending.

The decline in discretionary spending momentum was significant, dropping 5.1 points, while non-discretionary spending momentum only fell by 0.4 points compared to March 2022. This change in spending habits is the lowest discretionary SMI reading since September 2022, when public health authorities began managing COVID-19 as an endemic disease. Conversely, non-discretionary spending momentum rose to its most substantial level yet during this phase of the cycle.

The impact of inflation on discretionary spending momentum has more than doubled since 2020, almost equaling the effect of unemployment. The combined effect of inflation, interest rates, and unemployment has resulted in consumers spending less on discretionary items, such as luxury goods, and focusing on essential goods and services, including groceries and healthcare.

Despite recent developments in inflation, interest rates, and unemployment, experts predict that the shift towards non-discretionary spending will persist. Consumers will continue to prioritize essential goods and services as they adapt to economic changes and fluctuations in the market.

As economic conditions evolve, consumers are encouraged to stay informed about changes that could impact their spending habits. The Visa Australia Spending Momentum Index provides valuable insights into consumer spending and the factors influencing it. By keeping up with these changes, consumers can make informed decisions about their spending and plan accordingly.

In conclusion, the ongoing impact of inflation, interest rates, and unemployment on consumer spending habits in Australia cannot be ignored. As Australians adapt to economic changes, the focus on non-discretionary spending will likely persist, with consumers prioritizing essential goods and services.

Written by: Anne Keam