Sébastien Bazin, Chairman and Chief Executive Officer of Accor, said:

“Our performances during the third quarter point to a marked recovery of business during the summer season. The worst of the crisis is now behind us, but our main markets are still substantially affected by the measures rolled out to combat the health crisis. Only China reports solid performances and should swiftly recover its activity level pre-crisis.

Against this still uncertain context, discipline, adaptability and cost control are critical. We keep transforming our organizations to make the Group even more efficient, more agile, and focused on the most profitable and promising markets and segments. We are also deploying additional sources of revenue, in our hotels and in our loyalty program.

These efforts will help us benefit faster from recovery and pursue our ambitious development of the Group.”

(1) Like-for-like: at constant scope of consolidation and exchange rates.

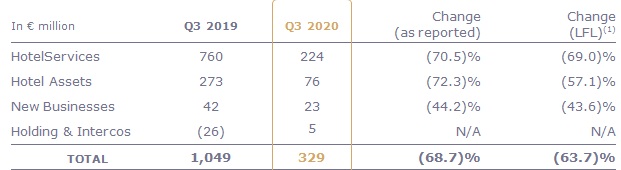

Reported data showed the following details:

- Changes in the scope of consolidation (acquisitions and disposals) had an adverse effect of €36 million, mostly caused by the disposal of Mövenpick hotel leases.

- Currency effects had an adverse impact of €16 million, mostly related to the US dollar (-4.5%) and the Brazilian real (-29.7%).

HotelServices revenue

HotelServices, which combines fees for Management & Franchise (M&F) and services for owners, generated €224 million revenue, down by 69.0% like-for-like. This points to the deterioration of RevPAR due to the impact of the Covid-19 epidemic and health restrictions taken by governments worldwide.

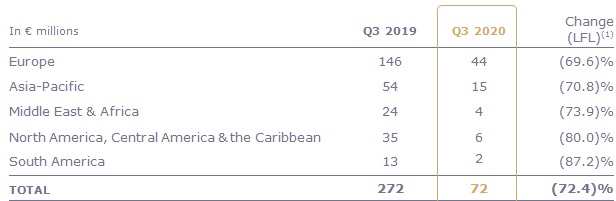

Revenue of fees from Management & Franchise (M&F) stood at €72 million, down by 72.4% like-for-like, with a considerable fall in fees based on hotels’ operating margins (incentive fees) in management contracts.

1) Like-for-like: at constant scope of consolidation and exchange rates.

The Group’s RevPAR dropped by an overall 62.8% during the third quarter.

In Europe, Management & Franchise revenue fell by 69.6% LFL, pointing to a 56.7% overall fall in RevPAR across all segments.

- In France, RevPAR was down by 44.6% like-for-like in the third quarter, a net improvement after a second quarter which lost 88.6%. This performance was the outcome of a recovery in leisure customers in provinces during the summer season (RevPAR down by 27.6%), while Greater Paris (RevPAR down by 72.2%) was affected by the absence of international customers.

- In the United Kingdom, RevPAR fell by 79.8%. Although less impacted, trends between London (-91.8%) and provinces (-67.2%) were comparable to the French figures. This reflects flows of national tourists in a country where border-crossing is still subject to severe restrictions.

- In Germany, RevPAR was down by 60.9%. Despite end of lockdown measures taken earlier than other European countries, RevPAR is still affected by a huge reduction in business customers, particularly from abroad.

- In Spain, RevPAR fell by 77.2% in the third quarter.

Asia-Pacific Management & Franchise revenue was down by 70.8% like-for-like, affected by RevPAR falling by 58.8%.

- In China, the third quarter (RevPAR fell by 29.4%) confirms the recovery of business observed in the second quarter of the year. This improvement continues month after month (September’s RevPAR was down by 16.8%), and the “golden week” vacation after the national holiday season (first week in October) confirms the potential of domestic tourism.

- In Australia, RevPAR fell by 62.7% in the third quarter. Business is restricted to domestic customers and hotel quarantines decreed by the government, since the country’s borders are still closed.

In Africa & Middle East, Management & Franchise revenue fell by 73.9% on the basis of a 69.9% RevPAR reduction due to border closures.

In North America, Central America & Caribbean, Management & Franchise revenue was down by 80.0%, in line with an 83.4% fall in RevPAR during the third quarter. Plunging fees based on hotels’ operating margins (incentive fees) were partially offset by a relatively sound performance by other revenues from Management & Franchise contracts.

Finally, in South America, Management & Franchise revenue fell by 87.2% on the basis of an 80.6% reduction in RevPAR, although this is gradually improving.

Revenue from services to owners, which includes Sales, Marketing, Distribution and Loyalty Divisions, shared services and reimbursed of hotel staff costs, stood at €153 million, as against €488 million at the end of September 2019.

Hotel Assets & Other Revenue

Hotel Assets & Other Revenue, standing at €76 million with a decrease 57.1% like-for-like, were impacted by the RevPAR decrease in Australia and Brazil. The “Strata” business in Australia benefitted from domestic leisure tourism in the country. In terms of reported data, the 72.3% fall was increased by the disposal of the Mövenpick hotel lease portfolio in early March 2020.

As of September 30, 2020, Hotel Assets accounted for 163 hotels and 29,441 rooms.

Revenue from New Businesses

By the end of September 2020, New Businesses (concierge services, luxury home rentals, private sales of hotel stays and digital services for hotel owners) had revenue dropping to €23 million, or down by 43.6% like-for-like.

FY 2020 EBITDA guidance

Accor usually announces an annual EBITDA guidance when it presents the half-yearly results and revenue for the third quarter. The present ever-changing environment and developments in the Covid-19 crisis do not afford sufficient visibility for a reasonable target range to be provided.

In this context, the Group is benefiting from its solid liquidity position, over €4 billion euros at the end of September, and despite limited visibility it is confirming 2020 operational sensitivity indicators as follows:

- An EBITDA sensitivity per point of RevPAR under €20 million,

- Monthly cash burn under €80 million

Group revenue in the third quarter of 2020 came in at €329 million, down by 68.7% as reported and by 63.7% like-for-like due to the effects of the health crisis.

RevPAR fell by 62.8% during the third quarter of 2020, a significant sequential improvement in the wake of a difficult second quarter (RevPAR down by 88.2%). This improvement reflects a recovery in business in all regions, and most especially in Europe during the summer season. However the downturn in leisure customers, in addition to the introduction of new restrictions after the end of August, pushed the recovery down in September.

Accor opened 57 hotels during the third quarter of the year, or 7,800 rooms, which are encouraging figures, in line with those of the 1st quarter (58 hotels, and 8,000 rooms). By the end of September 2020, the Group was operating 750,135 rooms (5,121 hotels), with a pipeline of 208,000 rooms (1,192 hotels) running at 75% in emerging markets.

By the end of September 2020, 90% of the Group’s hotels were open for business, or over 4,600 units.

Group revenue

Group revenue in the third quarter of 2020 came in at €329 million, down by 63.7% at constant scope of consolidation and exchange rates (LFL) and by 68.7% as reported data with respect to Q3 2019.