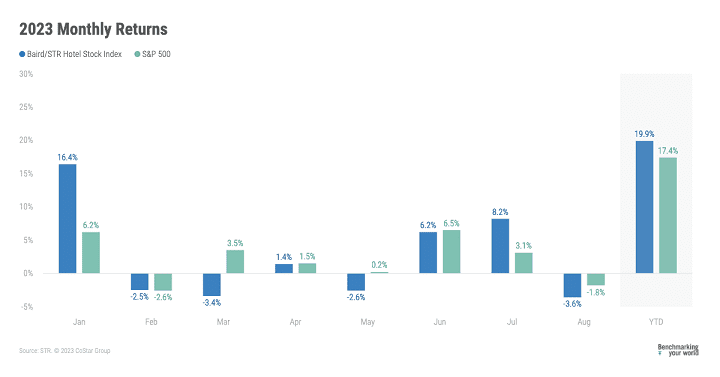

The Baird/STR Hotel Stock Index fell 3.6% in August to a level of 5,856.

The Baird/STR Hotel Stock Index fell 3.6% in August to a level of 5,856.

“Hotel stocks pulled back and underperformed in August with Hotel REITs the laggards,” said Michael Bellisario, senior hotel research analyst and director at Baird. “The Hotel REITs posted their worst month of the year due to weak second quarter earnings reports, reduced full-year guidance expectations, and several weather-related impacts across the country during the month; relative performance would have been even worse if not for Hersha’s take-private announcement during the last week of the month.”

“U.S. hotel performance showed improved year-over-year growth in August, as RevPAR rose 1.7% over 2022 because of a 2% increase in ADR,” said Amanda Hite, STR president. “Overall, summer performance was lower year over year as more Americans traveled internationally, and inbound travel to the U.S. remained at a deficit. We expect stronger performance in the coming months as group and conference demand accelerates to its annual peak.”

In August, the Baird/STR Hotel Stock Index fell behind the S&P 500 (-1.8%) and the MSCI US REIT Index (-3.2%).

The Hotel Brand sub-index dropped 2.2% from July to 11,242, while the Hotel REIT sub-index decreased 9.1% to 1,027.