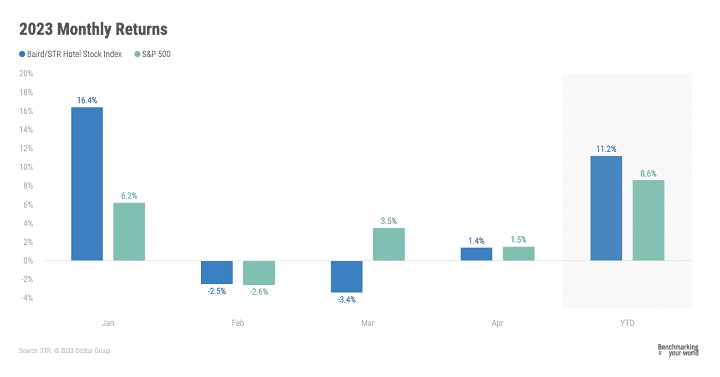

The Baird/STR Hotel Stock Index increased 1.4% in April to a level of 5,430.

The Baird/STR Hotel Stock Index increased 1.4% in April to a level of 5,430.

“Hotel stocks increased in April, and the gains were driven by outperformance from the global hotel brands,” said Michael Bellisario, senior hotel research analyst and director at Baird. “RevPAR trends have remained solid in the face of growing macroeconomic uncertainties and continued banking turmoil, and first-quarter earnings generally have surprised to the upside with positive full-year estimate revisions occurring. The Hotel REITs declined more than 2% in April and underperformed the RMZ, while the global hotel brands gained just over 2.5% and outperformed the S&P 500’s return by ~100 bps.”

“The industry continues to revert to normal patterns and calendar shifts with growth slowing as forecasted,” said Amanda Hite, STR president. “Monthly demand fell year over year for the first time since the recovery began in April 2021, but that decrease can be attributed to an extra Sunday on the calendar this year versus last. Without the extra Sunday, which is historically a low-performance night, demand would have been slightly up from last year. ADR, on the other hand, grew 3.4%, while RevPAR was up 1.8% – the lowest increase of the recovery thus far. Despite slowing growth, we expect the industry to see further gains throughout the summer and fall.”

In April, the Baird/STR Hotel Stock Index fell slightly behind the S&P 500 (+1.5%) but came in above the MSCI US REIT Index (+0.7%).

The Hotel Brand sub-index jumped 2.5% from March to 10,178, while the Hotel REIT sub-index dropped 2.6% to 1,045.