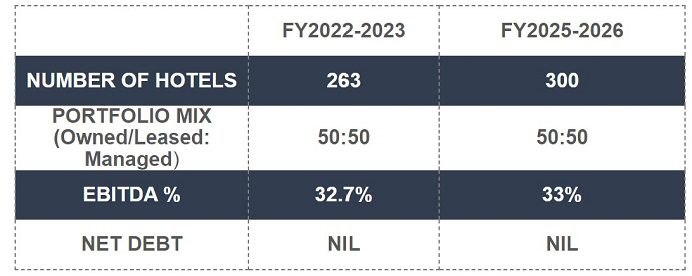

The Indian Hotels Company Limited (IHCL), the leading player in India’s hospitality market, has announced its impressive performance in the first year of its strategic roadmap, Ahvaan 2025. This ambitious plan aims to establish IHCL as South Asia’s most iconic and profitable hospitality company. The company’s focus on value creation, re-engineering traditional businesses, scaling re-imagined ventures, and restructuring its portfolio has yielded exceptional results. To have 300 hotels in its portfolio, achieve a 33% EBITDA margin, and have a 35% EBITDA contribution from new businesses and management fees by the fiscal year 2025-26, IHCL is on track to achieve its goals.

The Indian Hotels Company Limited (IHCL), the leading player in India’s hospitality market, has announced its impressive performance in the first year of its strategic roadmap, Ahvaan 2025. This ambitious plan aims to establish IHCL as South Asia’s most iconic and profitable hospitality company. The company’s focus on value creation, re-engineering traditional businesses, scaling re-imagined ventures, and restructuring its portfolio has yielded exceptional results. To have 300 hotels in its portfolio, achieve a 33% EBITDA margin, and have a 35% EBITDA contribution from new businesses and management fees by the fiscal year 2025-26, IHCL is on track to achieve its goals.

Under Mr Puneet Chhatwal, the Managing Director and Chief Executive Officer of IHCL, the company has witnessed an impressive start to its Ahvaan 2025 strategy. IHCL has achieved record-breaking financial performance for four consecutive quarters, surpassing its previous milestones. Notably, IHCL recorded a historic profit after tax (PAT) of over INR 1,000 crores while maintaining a zero net debt status. Over the past year, IHCL expanded its portfolio to include 263 hotels and achieved an ideal balance between owned/leased hotels and managed properties, with a 50:50 mix.

With a reimagined brandscape, industry-leading brands, operational excellence, and a strong presence in over 125 cities, IHCL is well-positioned to deliver on its vision. The company’s commitment to its guests, demonstrated by the unwavering trust and the dedication of its colleagues guided by the ethos of Tajness, further strengthens its position in the market.

IHCL’s success can be attributed to its strategic initiatives to re-engineer traditional businesses, which resulted in revenue growth of over 20% and a remarkable 15.2 percentage point margin expansion. The company introduced the renowned global Italian brand Papermoon in Goa, launched the innovative Indian restaurant concept Loya, and expanded its popular establishments, House of Nomad and 7 Rivers, in Goa.

In scaling up its re-imagined businesses, IHCL achieved significant milestones. Ginger, IHCL’s economy brand, now boasts a portfolio of 85 hotels and is profitable for the first time, reporting a profit before tax (PBT) of INR 48 crores. TajSATS, a leading player in airline catering, achieved an all-time high EBITDA margin of 19.7% and a PBT of INR 107 crores. The branded homestay offering, amã Stays & Trails, experienced steady growth and now comprises 114 properties. Additionally, Qmin, IHCL’s culinary platform, expanded to multiple formats, including all-day dining options in Ginger hotels, and currently operates 34 outlets.

IHCL’s portfolio restructuring efforts yielded fruitful results as well. The company achieved a 50:50 balance between owned/leased hotels and managed properties by signing agreements for 36 hotels. Taj, the flagship brand of IHCL, achieved a significant milestone by reaching 100 hotels worldwide. As per Brand Finance, this achievement further solidifies Taj’s position as the world’s strongest hotel brand and India’s most robust.

IHCL recognizes the importance of sustainable and responsible tourism, and to that end, it unveiled its comprehensive ESG+ framework called Paathya. This framework drives IHCL’s sustainability and social impact measures, with significant progress in its first year in renewable energy adoption, plastic waste reduction, heritage conservation, and skill development initiatives.

Written by: Madhura Katti