- August 2020 earnings season is expected to unfold as a major sink or swim catalyst for the nation’s share market.

- The approaching earnings season will possibly reveal the extent of coronavirus disruption to the travel industry, which bore the maximum brunt of social distancing and border restrictions.

- There is still a beacon of hope for the industry’s revival with the possible resumption of overseas journey gradually and an upsurge in domestic travel segment.

- However, much depends on the containment of second wave of virus infections in Victoria that can act as a roadblock in sector’s road to recovery.

While the US Q2 2020 earnings season failed to cheer investors so far amid mixed impact of the COVID-19 pandemic on companies’ profits, all eyes are now glued to Australia’s August 2020 earnings season that is expected to unfold as a major sink or swim catalyst for the nation’s share market.

Even though gradual absorption of virus-induced risks, together with economic recovery hopes, aided equity market revival from March 2020 trough, the focus now turns to “beats” and “misses” of the upcoming earnings season.

The attempts to retain financial stability and business continuity kept the corporate community in spotlight since the emergence of coronavirus crisis. While some raised capital to better absorb the COVID-19 shocks, others relied on government support to sail through the virus crunch.

Moreover, some counted on both equity raising and government stimulus to weather the virus crisis, including hard-hit travel players. The approaching earnings season will possibly reveal the extent of coronavirus disruption to the travel and leisure industry, which bore the maximum brunt of social distancing and border restrictions.

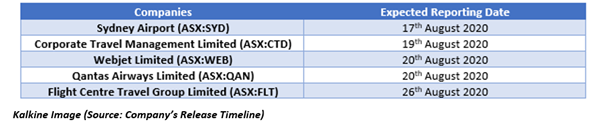

A Glance at Travel Companies’ Earnings Calendar

The table below summarises a list of ASX-listed travel players that are expected to announce their earnings in August reporting season:

The year 2020 has so far been a tough year for each of these travel companies, which largely carried the weight of coronavirus induced travel bans. The actions taken to curb the spread of virus sparked a sharp downturn in passenger traffic besides widespread job losses across these companies this year.

For instance, Sydney Airport’s (ASX:SYD) total passenger traffic plummeted by ~95 per cent in June this year as compared to prior corresponding period amid existence of international travel curbs.

Moreover, Qantas Airways Limited (ASX:QAN) declared around 6,000 job losses and decided to lay off 15,000 workers in April this year to sail through coronavirus downturn.

Are there any Emerging Green Shoots?

While the travel sector is not out of the woods yet, there is still a beacon of hope for the industry’s revival with the possible gradual resumption of overseas journey and an upsurge in domestic travel segment. High hopes are attached to the potential execution of the trans-Tasman travel bubble with New Zealand, which can deliver a firm start to COVID-19-crushed travel business.

Additionally, the government’s recent decision to extend the current JobKeeper Payment support by a further six months to 28th March 2021 is expected to provide a lifeline to travel businesses reeling from virus crisis.

On the bright side, ACCC (Australian Competition and Consumer Commission) has also recently proposed that Regional Express Holdings Limited (ASX:REX) will be permitted to continue to coordinate flight schedules with Virgin Australia Holdings Limited (ASX:VAH) and Qantas on ten regional routes. The regulator’s decision appears to address extremely low demand for air travel during coronavirus pandemic.

Despite these promising indications, much depends on containment of the second wave of virus infections in Victoria that can act a roadblock in sector’s road to recovery.

What Else is Expected from August 2020 Earnings Season?

The approaching earnings season is expected to remain muted for Australian banking sector, with big four banks likely to defer or slash their final dividend payments amid uncertainty around capital adequacy and default risks.

The COVID-19 driven repercussions weighed on big four banks’ interim payouts this year, with Westpac Banking Corporation (ASX:WBC) and Australia & New Zealand Banking Group (ASX:ANZ) deferring their 2020 interim dividends, while National Australia Bank Limited (ASX:NAB) slashed it by 64 per cent.

On the flip side, the imminent reporting season is anticipated to fare well for the technology industry that has stayed at the forefront in coronavirus era to drive business innovation and sustenance. Notably, the S&P/ASX 200 Information Technology Index has revived by over 85 per cent since the March dip, backed by a significant global shift towards digitisation.

In addition, the healthcare sector is also reasonably positioned to surprise investors to the upside amidst the fast-tracked race to develop COVID-19 vaccine/ treatment and burgeoning demand for healthcare equipment and treatments.

Moreover, iron ore players such as BHP Group Ltd (ASX:BHP), Fortescue Metals Group Ltd (ASX:FMG) and Rio Tinto Limited (ASX:RIO) are expected to have a sunny day amidst strong pricing scenario.

On the contrary, the effects of coronavirus-driven lockdown are likely to deliver a massive blow to the retail sector earnings, despite a M-o-M surge of 2.4 per cent in June 2020 retail sales. While, e-tailers such as Kogan.com Limited (ASX:KGN) and JB Hi-Fi Limited (ASX:JBH) may debunk the trends on the back of strong demand for online commerce.

All in all, a potent mix of tea leaves may be born in mind while navigating through the equity market in the near term, including upcoming reporting season, fears of second wave of infections, global macro fundamentals, further Government stimulus and possible re-imposition of lockdown. Investors may stay nimble and hold long-term position while escaping hasty decisions to wade through potential losses.

Source: Kalkine Media